Federal Open Market Committee

The Federal Open Market Committee is an organization within the Federal Reserve System in the United States that controls monetary policy for the central bank. This organization is tasked with controlling and implementing three distinct tools of monetary policy:

- Open market operations

- The discount rate

- Reserve requirements

Open market operations refers to buying and selling U.S. Treasury and federal government assets on the open market as a means of influencing the economy. The discount rate refers to the central lending rate set by the FOMC, which basically tells banking institutions how much it will cost them, per percentage points, to borrow money from the reserve system. Finally, the third tool, reserve requirements, refers to how much deposits, or funds, a bank must have on hand against liabilities, such as money that is loaned at interest. By combining use of these three tools, the FOMC tries to influence the economy through monetary policy application.

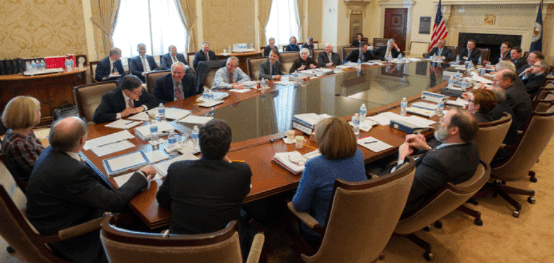

Federal Open Market Committee Structure

The FOMC has twelve members, comprised of members of the Federal Reserve System. Seven of these are members of the Federal Reserve’s Board of Governors. Another member is the president of the Federal Reserve Bank of New York. The remaining four spots are rotated amongst the eleven additional Reserve Bank presidents. Each rotation is one year in duration, and the rotating members come from four geographical groups in the country.

As a body, the FOMC meets eight times per year. During each meeting, the members of the Committee discuss current economic conditions, assess the strength of the economy, and coordinate policy decisions in order to influence the economy. For example, to help with the recovery from the 2008 financial crisis, the FOMC has sought to keep the lending rate near historical lows of 0.0% to 0.5%, as a means of spurring investment and spending and liquidity in credit markets.

Impact of the Federal Open Market Committee on Forex Trading

As the key monetary policy body in the United States – the largest economy in the world and home of the central trading currency, the U.S. dollar – the Federal Open Market Committee is extremely influential when it comes to forex trading. Forex traders always look to the FOMC for guidance on where the dollar will go, since its actions directly influence the strength or weakness of the dollar versus other currencies.

One key decision reached by the FOMC came with its decision to initiate a round of asset purchases called quantitative easing II. In this decision, reached in November, 2010, the Federal Reserve committed to purchasing approximately $900 billion in assets by the third quarter of 2011. This influenced forex trading because it essentially put more dollars into circulation, which reduces the overall value of the dollar and causes USD values to drop.

Raising or lowering the interest rate can also impact forex trading because it affects demand for the currency. Raising interest rates spurs demand because investors can receive a higher return on investment, percentage-wise, than a currency with a lower interest rate. Lowering the rate has the opposite effect, even if the intent is to stimulate the economy. For this reason, traders pay close attention to the FOMC when it discusses the interest rate.

Comments (0 comment(s))