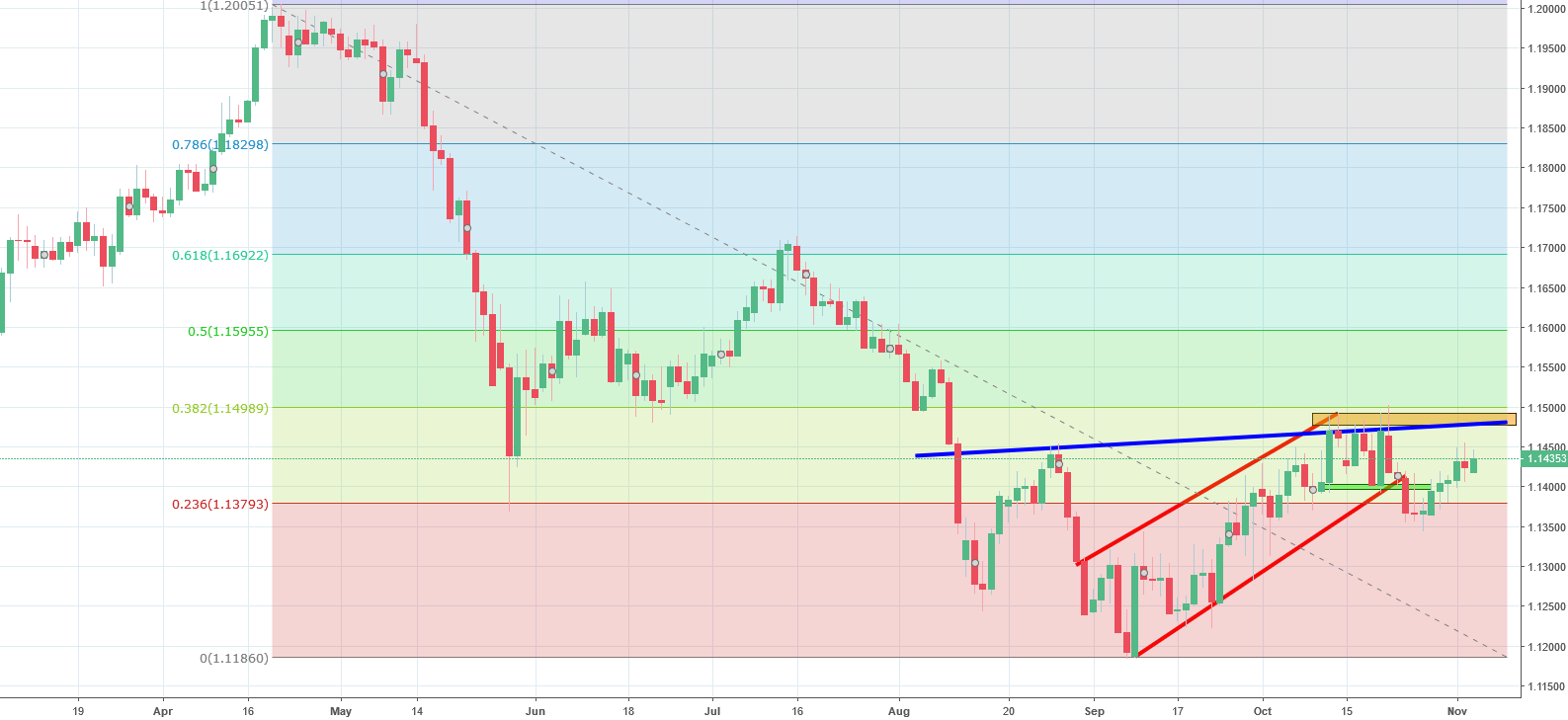

EURCHF Analysis – From flag to the iH&S

The second instrument of the day is the EURCHF, which was previously mentioned here on the 24th of October. Back then, the situation looked very pessimistic and we had great chances for a further slide. The setup was very technical and I saw a great chance of success:

“The breakout of the lower line of the flag is happening now. That gives us a legitimate trading signal. The target is on the lows from September and chances hat we will get there are very high. „

The decline lasted for the next two days and the maximum that we got from it was 50 pips. That was it though. The price reversed and is currently drawing the right shoulder of the inverse head and shoulders pattern. We went very quickly from the bearish flag from the previous analysis to the bullish iH&S seen now. The buy signal from this pattern, will be triggered, when the price will break the blue neckline. In addition to that, we should break the 38,2% Fibo and the horizontal resistance marked with an orange colour. The price closing a day above those resistances will give us a proper buy signal.

Comments (0 comment(s))