MetaTrader 4 vs cTrader – Differences and Similarities

One of the essential elements of any trading endeavor is the software. Without it, you simply wouldn’t be able to open new trades on the market.

Among the most popular trading platforms, there are MetaTrader and cTrader that are the top-of-the-line pieces of software. They have been available for more than a decade now and in that time, traders and brokers have taken these platforms to their paces.

A brief comparison

In the following article, we’re going to focus on MetaTrader 4, instead of the cTrader vs MetaTrader 5 comparison, because MT4 is more popular and widely used in the industry than its modern counterpart. Yet we will still mention some key characteristics of MT5 that resemble those of cTrader.

When it comes to the differences and similarities between cTrader and MT4, you can be sure that there’s a lot to talk about. The first obvious difference is the design: MT4 has a more old-school look to it, whereas cTrader allows for greater customizability of the interface, not to mention modern touches in its design.

Internally, the two pieces of software couldn’t be more different from one another. MT4 is based on MetaQuotes’ MQL4 programming language, which is a more specific code that isn’t exactly useful for programmers outside the trading industry; yet it still has a huge user base within it. As for cTrader, it uses a more common C# language that allows other programmers to create tools for it.

Then there are internal features that enhance the fundamental difference between MetaTrader and cTrader. MT4 is a more beginner-oriented software for Forex traders while cTrader supports more professional features: MT4 offers 3 charts, whereas cTrader has 4; MT4 features 9 timeframes, where cTrader has 26, and the differences go on and on. Now, let’s dive deeper into our comparison between the two platforms.

cTrader vs MetaTrader review – Where do they come from?

First off, let’s take a quick look at how these platforms came to existence. MetaTrader 4 is a piece of software created by MetaQuotes in 2005. Its release marked a new beginning on the trading market as it introduced new features and new ways to trade Forex.

Speaking of Forex, MT4 was originally developed for Forex traders. That’s why the software has a strict limitation on how many instruments it can support.

When it comes to cTrader, it was developed in 2011 by a company called Spotware. It came out at around the same as MetaQuotes released the new MT5, and while the differences between cTrader vs MT5 was still great, the two platforms had more common features such as the economic calendar, a greater number of instruments, etc. – the features that weren’t available in MT4.

The interface differences

Now, let’s move on to the interface of MT4 and cTrader and see how they compare to one another:

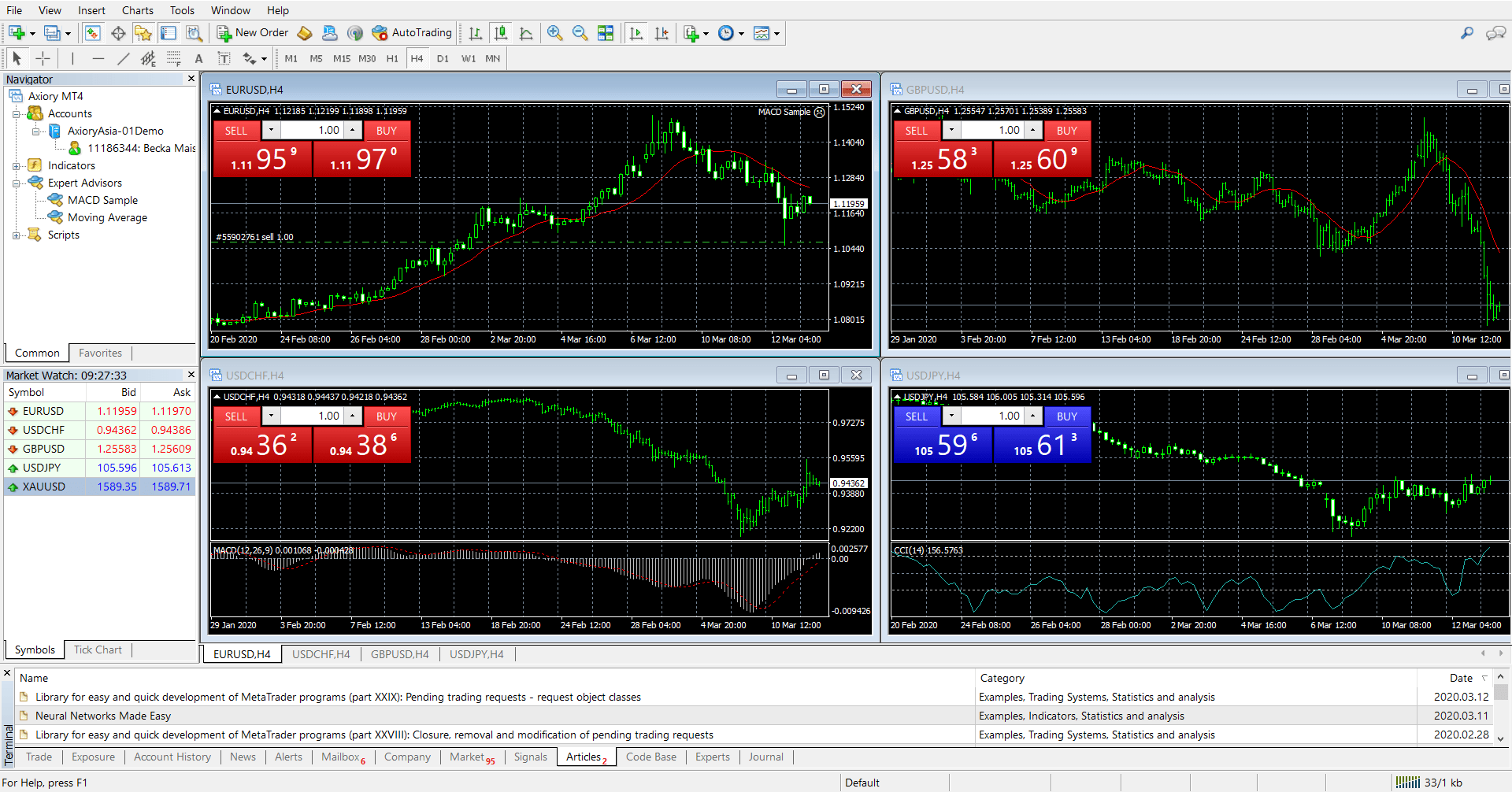

MT4 has this Windows 98-kind of look with boxy windows and boxes. The layout is pretty much the same for both MT4 and MT5: a huge portion of the display is taken by four individual charts that can be rearranged or expanded so that you can only see one chart on the screen.

On the left, there is the Navigator and Market Watch windows where you can select your indicators/research objects, as well as trading instruments. At the bottom, you can see the history of the trades, as well as market news and many other details.

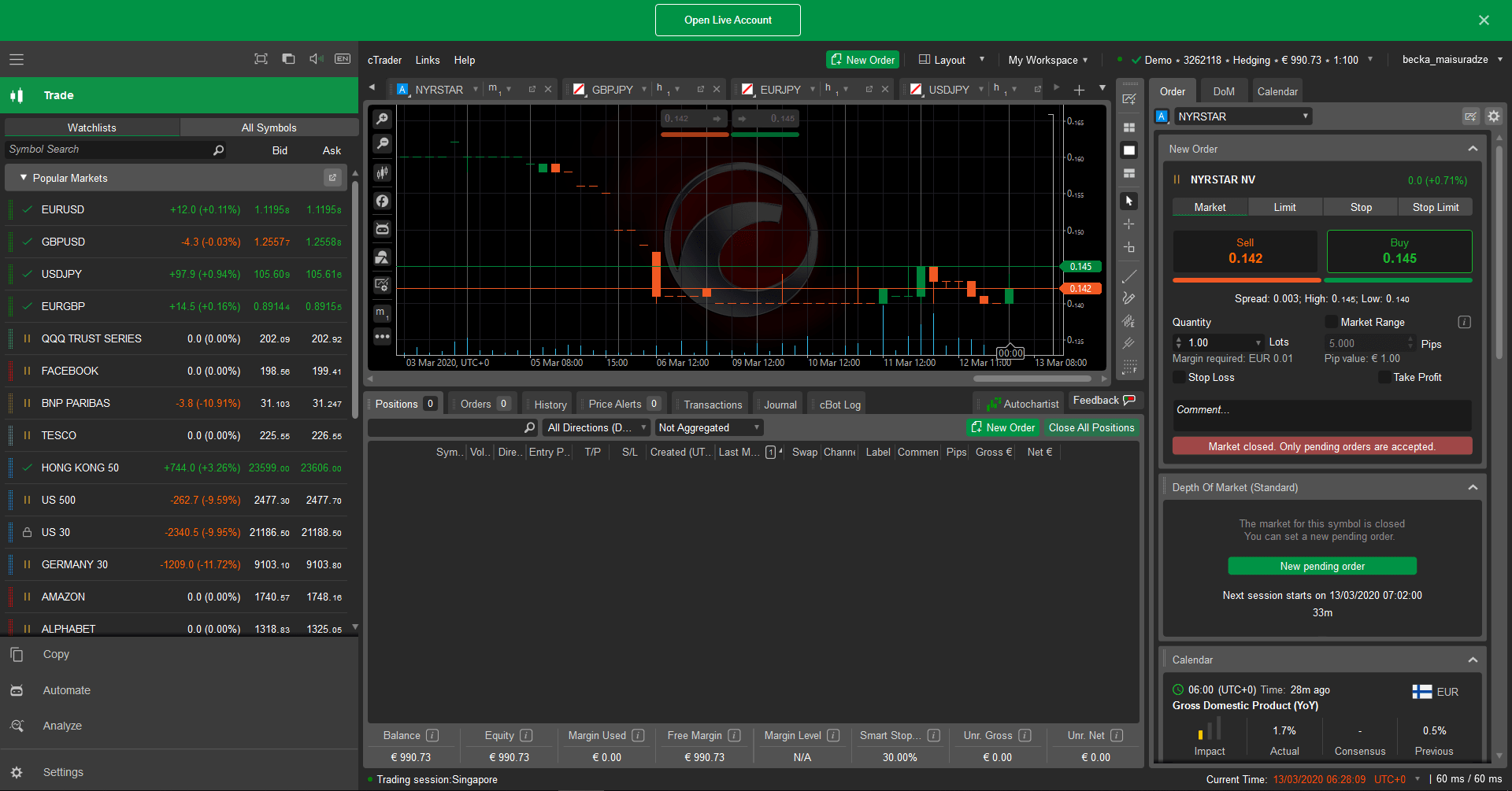

To compare cTrader vs MetaTrader, the difference becomes very obvious. cTrader is a much more modern-looking platform, as well as more simplistic. Not only is the interface more pleasant to look at, but you can also choose its theme from a bunch of options, including light and dark themes.

As for the layout, the center of the screen is still taken by a chart but it is less dominant and you can only get one chart at a time. On the left side, there is the Watchlist window for your instruments, on the right – the control panel for your trades, and at the bottom – the history, price alerts, and many other features.

Is cTrader better than MT4 with its features?

After the design comparison, it’s time to dive deeper into the internals of MT4 and cTrader and determine, which one offers more features. First off, let’s take a look at the programming language that the two pieces of software use.

MQL4 vs C#

In the MetaTrader and cTrader comparison, one of the more fundamental differences is the coding language that they’re based on. On the one hand, there is MetaTrader 4 that uses the MQL4 programming language.

As pointed out earlier, MQL4 is a trading-oriented software that is usually used by traders and financial analysts. This means that outsider programmers don’t really find it usable for their coding endeavors. However, since MT4 has been around for more than 15 years now, MQL4 has garnered a huge user base, ultimately resulting in lots of indicators and other tools developed in that language.

On the other hand, there’s cTrader with a more common C# programming language. Using this language in trading has both its advantages and disadvantages:

- An advantage is that C# is widely used by many programmers outside the field, which means pretty much anyone can create additional new features for cTrader;

- In reality, however, there aren’t many C# programmers in the trading world that create tools for cTrader, which is why in this MetaTrader 4 vs cTrader comparison, mT4 is more advantageous.

Differences in charts

The next discussion point of our article is going to be the chart offerings. With charts, you can observe prior, as well as live, price movements of your assets, analyze them, and conduct technical analysis for more accurate trades.

With MT4, you can get three of the most popular chart types:

- Line

- Bar

- Candlestick

As noted earlier, you can have four individual charts visible on the screen, your you can also expand one particular chart on the whole screen. And in order to change from one type to another, you can either right-click on the chart choose the preferred type or go to the menu in the top-right of the screen and choose it there.

In cTrader, all three charts are still there with one more additional chart – dots chart. Interface-wise, one chart is located in the center of the screen and you can change its type by right-clicking on the actual chart and choosing your preferred layout.

As for the available timeframes, we can still see significant differences between cTrader vs MetaTrader 4. In MT4, there are 9 timeframes – 4 minute, 2 hour, daily, weekly, and monthly timeframes. In cTrader, that number is much higher at 26 timeframes – 14 minute, 7 hour, 3 day, weekly, and monthly timeframes.

Which instruments can you trade with these platforms

When it comes to the available trading instruments, it is very important to note that it only depends on the broker which assets you’ll get with the software. For instance, if the broker decides to integrate only cryptocurrencies in the platform, it can do that without a problem.

With that being said, though, there are limitations as to how many assets a software can accommodate. For instance, MT4 can go up to 1,000 instruments, whereas there’s no hard limit to the number of assets cTrader can accommodate.

For that reason, it is more reasonable to use MetaTrader 4 for Forex trading, considering the fact that there is a relatively low number of currency pairs on the market. On the other hand, cTrader can be a great platform for stocks, indices, commodities, and other instruments that come in much larger numbers.

Besides these inherent differences, either with cTrader or MetaTrader you can easily observe your instruments and choose them for your trades pretty easily. In MT4, there’s a Market Watch window on the left that contains all of the available instruments incorporated by the broker. In cTrader, there’s a pretty dominant Watchlist and All Symbols window that also offers the same functionality.

Other very useful features

Besides these fundamental differences and similarities, we can also find many other areas that differentiate the two platforms from one another. One such area is automatic trading. MetaTrader 4 (5 as well) is widely known for its Expert Advisors feature – a set of manually created programs that allow traders to automate their trades. With it, not only can they tell the software to automatically open and close trades, but they can also create autonomous technical analysis tasks that predict the future price movements for you.

The difference between MT4 vs cTrader in terms of automated trading lies mostly in the naming and some cosmetic features. cTrader’s auto trading feature is powered by cBots. cBots are based on C# language and because of that, they can be moderated by other developers outside the industry. Yet for the most part, both cBots and Expert Advisors do pretty much the same thing.

Then are other features that either set the two platforms apart or bring them closer together. For instance, both MT4 and cTrader offer the backtesting platform. Backtesting allows you to set the exact parameters that you would use in the actual trade, then run the software and see, how these parameters would work for the past price movements. This can be a great feature to test out your strategies without risking anything.

Another feature that enhances the difference between cTrader vs MT4 is market depth. Market depth allows you to see how individual traders and their decisions can influence the condition of the whole market; ultimately, it shows how much influence the market can take before it drastically changes. The difference between these platforms is that only cTrader features market depth, not MT4. And if you do want to stay in the MetaTrader environment, you can go for MetaTrader 5 that also offers this functionality.

Should you choose MetaTrader or cTrader? – A conclusion

In the trading industry, both MetaTrader and cTrader platforms are very renowned for their popularity, as well as the features that they offer. In this article, we did a comparison between MetaTrader 4 vs cTrader and talked about some of the most fundamental features that either differentiate them or make them similar to one another.

Some of the biggest differences between the two pieces of software can be found in their designs, programming languages, number of supported instruments, etc. In many aspects, cTrader proved superior to its MetaQuotes counterpart, yet there were areas where MetaTrader 4 was more advantageous.

Be that as it may, there are use-cases for both of these platforms. Usually, beginners and Forex traders can make the most of the MT4 software, whereas traders from other industries and with more professional needs can utilize the offerings of cTrader. Either way, you won’t be disappointed by either of these platforms.

Comments (0 comment(s))