Contents

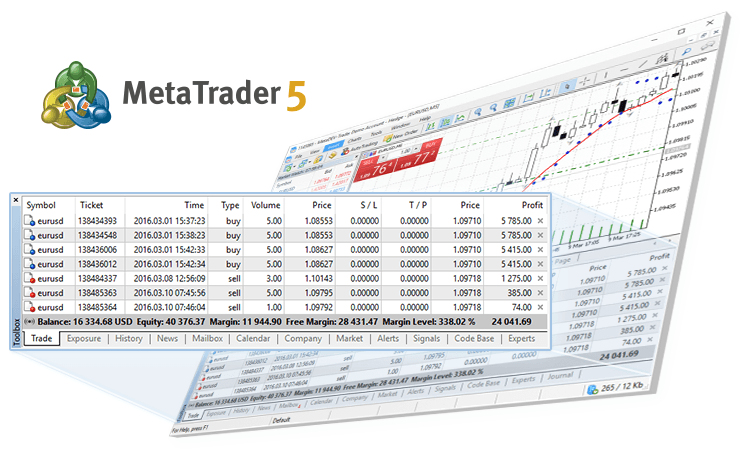

We all love to get updates, don’t we? I know I anticipate every update on my smartphone and make sure I am the first of my friends to get and flaunt it. The same is true, at least for me, when I find that there is a new software version, especially if it is something that makes me money. Therefore, you can imagine my enthusiasm when I learned that the latest MetaTrader version, MetaTrader 5, had been released. Understand that I learned about this a few years back, so my enthusiasm was quickly trashed when I found out just how few MT5 Forex brokers there were.

Apparently, not everyone is always as eager as I am to get an update. Nevertheless, more and more Forex brokers have begun embracing the change, and it is now easier to find a Forex broker offering MT5 along their other trading platforms. This post is for those like me who like to try out new things, but also for those traders who want to have an edge over others around the world. If you would allow me to tell you why I use MT5 myself, I promise you will be making the download after you’re done reading this post.

MetaTrader 5 first became available in 2010 after it was developed by its parent company MetaQuotes. You may recognize the company, MetaQuotes since it is the same that released MetaTrader 4 half a decade earlier. They were hoping that MT5 would replace MT4 and become the new industry standard. Obviously, now we know that this hope has not become reality since it has been about seven years later and MetaTrader 4 is still more popular. Despite the seeming lack of enthusiasm for the new software, it does have plenty of new features to make it a better option to a Forex trader. More of us traders are beginning to spot these advantages, which is why the MetaTrader 5 brokers list has been steadily growing in recent years. Sure, perhaps the uptake and adoption of the new software may have been slow, but I would argue MT5 might overtake MT4 by 2020.

I understand why traders have not been so eager to jump on the MT5 wagon just yet, primarily because its predecessor, MT4, still has a stronger community behind it. As a Forex trader, you have to rely a lot on the worldwide community of traders; like it or not. As far as I know, there hasn’t been a solitary trader who has consistently made the right decisions and become a success. Mostly, we rely on the community for information regarding future market moves. Can you imagine reading up on more than 20 countries’ economies and being able to deduce how those will affect the markets? It is extremely difficult and I bet you to try. However, through the online community, you can find clues about where to look, thus being able to narrow your focus on potentially profitable markets.

Moreover, we find a lot of support in the online community in form of trading signals and custom technical indicators. As I mentioned before, the MT4 community is stronger and more populous, which of course means that there are more indicators and signals to be found. Even the best MetaTrader 5 Forex brokers cannot supplement what one loses when switching over to MT5. Unfortunately, the MT5 platform cannot use MT4 objects and vice versa because the two platforms use different programming languages. We shall look at this later.

So far, it would seem as though I have only been putting down the MetaTrader 5 platform, but I just like to put the negatives out of the way initially. Now I recommend opening an MT5 brokers demo account to see just how the advantages outweigh the disadvantages. Some of these include:

If MetaTrader 4 was smooth and efficient, MT5 takes that a notch higher. As mentioned earlier, MetaTrader 5 uses an improved programming language called MetaQuotes Language 5 (MQL5) as opposed to MetaTrader 4’s MQL4. The newer programming language was created to increase efficiency and execution speeds. There is one slight caveat, though, that MT5 works better on modern 64-bit systems than on 32-bit systems. This is because MT5 is a multi-threaded platform that will increase performance and, most importantly, backtesting speeds. More on that later. This means that, if you have a modern computer, you will definitely experience improved overall performance using MT5.

Furthermore, it increases the speed of transactions because it is not limited to one server as MT4 is. This new feature makes transaction speeds to increase, which is very good news for anyone engaging in high-speed trading using robots, scalpers and even trading in volatile markets. Overall, there is a noticeable improvement in performance using MetaTrader 5 and the top MT5 FX brokers know it.

What do you first do when you download a custom technical indicator from the online community? I really hope your answer was, running the strategy tester. Anyone can make a custom technical indicator, but it doesn’t mean it works well, or perhaps the settings are not right according to your trading strategy. In order to confirm the effectiveness of a technical indicator, therefore, you have to run the strategy tester, preferably over the past few years. If you have ever done this before, you know how much of a pain it can be because it takes so long.

This is not so on MT5 since it uses multiple CPU threads. In fact, the speed of backtesting can increase hundredfold depending on the processing power of your computer. You can confirm this yourself if you already have a demo account from a Forex broker MT5 and make your own conclusion. This is no small addition since it can mean the difference between a successful strategy and a loss on your account.

MetaTrader may have plenty of pre-installed indicators, and technical analysis tools, but MT5 has more. For example, where MT4 has 30 indicators preinstalled, MT5 has 38. The most significant additions, though, aren’t even in the technical analysis section. Take the depth of market feature that is unique to MT5, which I consider to be the most important addition. If you have ever wanted to know what other traders are doing at any given time, this tool tells you just that. If you manage to find the best MT5 Forex broker with thousands of clients, their trade positions will be made available to you. That way, you know on which side most of the traders are leaning. To me, this is like the commitment of traders (COT) report on steroids and what gives MT5 users a gigantic edge.

Then there is the inclusion of the economic calendar tab right on the platform, no longer forcing you to browse through the web for recent news. Perhaps you may not appreciate that, but how about the new trading orders. There is an addition of two types of pending orders as well as the ability to make partial orders. All of these new features provide added flexibility in terms of trade execution and management, making it more effective to manage your capital. Even the timeframes have been increased, just in case you’re bored with the same old 9 timeframes.

Most of all, MetaTrader 5 is future proof, meaning that having it should give you security that MetaQuotes will keep providing support for many years to come. For example, one advantage the MQL5 language had over MQL4 was the ability to perform ‘black box’ programming. This was an easier way to create code and develop trading robots, expert advisors, etc. Since there were still plenty of traders using MT4 and only a handful of MetaTrader 5 Forex broker, MetaQuotes pushed the same update to MT4 in 2014. Nevertheless, MetaQuotes have been actively promoting MT5 over MT4, indicating an interest for them to focus on the newer software version. If this campaign succeeds, which it probably will, then MT4 may lose key support from its developer. To make it easy, just think of MetaQuotes as Apple. How much longer do you think they will keep supporting iOS 9?

I’m pretty sure by now that you’re eager to at least try MT5 when the markets open, which indeed you should. The most important factor to watch out for is the number of instruments that particular broker has to offer. As you may know, one advantage of the MT5 platform was that it would expand the number of markets traders would have access to. Therefore, only the MetaTrader 5 broker with most instruments is worth considering. Otherwise, there would be no need to switch over. Consider this, how are you going to make use of all the new additions on the platform if there aren’t a variety of markets to choose from? In fact, MT5 with stocks is much more effective compared to MT4 and even some other trading platforms.

$100

CySEC, CBI, ASIC, FSCA, FSA, BVI FSC, ADGM

1:400

2006

MT4, MT5, WebTrader, AvaTradeGo

5$

CySEC, FCA

30$, 50%+20%

1:888

2009

MT4, WebTrader

$10

IFSC

1:2000

2009

MT4, MT5, R WebTrader, R MobileTrader, R Trader

$10

FCA, CySEC, FSA, FSCA

1:Unlimited

2008

MT4, MT5, WebTerminal

$10

CySEC

N/A

1:30

2013

WebTrader

10 USD

N/A

Affiliate Program

1:500

2019

MT4/WebTrader

250$

FCA, NFA

N/A

1:200

1999

MT4

0.01 BTC

N/A

N/A

1:1000

2018

Web trader, Android, and iOS apps

1 USD

ASIC, FCA

10 USD

1:500

2005

MT4, MT5, WebTrader

250 USD

FSCA

N/A

1:200

2012

MT4, WebTrader, Copykat

15

CySEC

30%

1:500

2015

MT4

250 EUR

FSA, Seychelles

None

1:200

Unknown

Custom

The next factor will have to do with the broker’s reputation. Keep in mind that this has got nothing to do with the broker themselves and your attitude toward them, but the safety of your capital. If a broker cannot be trusted, then they might happen to be scammers who may run with your money. To establish their reputation, check to see if they are regulated by a reputable financial regulator. For example, MetaTrader 5 brokers UK could be more trustworthy than those in Cyprus because the FCA is a more trusted regulator than CySEC.

Finally, check the little details in the broker’s offerings and how these factors may affect your day-to-day trading experience. These will include the small stuff like minimum capital requirements, leverage, spreads and commissions, etc. At first, it may be easy to ignore them, but they come back to bite you in the long run if you’re not careful.

Get the most recent news at your inbox

Stay up to date with the financial markets everywhere you go. We won’t spam you.