How to Trade Forex During News Releases

Perhaps one of the best forex trader strategies when it comes to profiting from the release of key fundamental information about an economy is popularly known as news trading. This forex strategy can easily be implemented using a variety of forex trading brokers in an online trading account, and so is available for use by retail traders.

Several news trading strategies exist, and the choice of which strategy is the right one to use will depend on the situation that presents itself to the trader. The following sections will describe two fairly common news trading strategies that can be used to profit from information readily available via online forex news.

Trading Around Scheduled Economic Data Releases

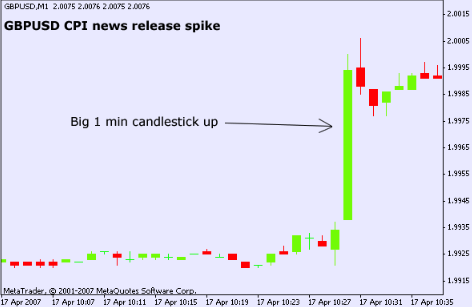

A number of key economic data releases can cause substantial volatility in the forex market for major currency pairs quoted by forex trading brokers if their result differs substantially from what the market’s consensus was expecting.

Perhaps the best known volatility event in the forex market is the monthly release of the U.S. Employment Report by the U.S. Bureau of Labor Statistics on the first Friday of each month that includes the key Non-Farm Payrolls or NFP number. If the NFP number is higher than expected, the U.S. Dollar usually rises across the board. Conversely, if the NFP result is below expectations, the U.S. Dollar tends to fall.

The NFP number is notoriously volatile and so it often does not come out as expected. This means that the best forex trader news strategies can be used to take advantage of the sharp exchange rate swings in currency pairs involving the U.S. Dollar that are commonly observed immediately after its release.

Using Hedged Forex Strategies to Trade News Releases

For example, some forex traders might position themselves on both sides of the market in their online trading account by establishing a hedged position, although this strategy is typically not available to U.S. based traders using online forex trading brokers due to recent changes in NFA/CFTC regulations.

Entering into a hedged position with an online forex broker typically means that the trader will go both long and short the market in the same currency pair in equal amounts of the base currency. They then await the key number’s release so that they can leg out of the hedged position in their online trading account.

For example, they might quickly “lift” or close out the losing leg after the market’s initial knee jerk reaction to the data with the overall objective of profiting further on the winning leg as the market subsequently continues to move in that direction.

On the other hand, if they thought the market’s initial response might be short lived, they could instead sell out the winning side of the hedge in their online trading account as the market’s initial response seems to wane. This would leave them holding the losing side of the hedge in their online trading account in the hopes of seeing a retracement as the market snaps back like a stretched rubber band.

They wait for the number to come out and then proceed to trade out of the position. For example, they might take a loss on one side during a post number correction, after having hopefully taken a larger profit on the winning side of the trade.

An alternative hedge technique involves putting stop loss orders on each side of the hedge with their online forex broker and then continuing to run the winning side to earn additional profits.

Using Straddle Strategies to Trade News Releases

Those forex traders who have access to the currency options market via their online forex broker can also buy a straddle strategy that expires after a major online forex news release.

This classic option strategy involves simultaneously buying both a put and a call on the base currency in a currency pair with identical strike prices for a premium that is paid up front, and which represents their maximum loss on the transaction.

The trader then aims to leg out of the straddle as the market swings up and down after the release of the anticipated information to the online forex news community.

For more forex broker reviews and information, follow us on Twitter or Like us on Facebook!

Comments (0 comment(s))