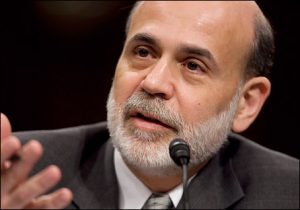

Ben Bernanke

Ben Bernanke (b. December 13, 1953) is the current Chairman of the Board of Governors of the Federal Reserve, the organization that oversees the monetary policy and infrastructure of the United States. Newsweek currently ranks Bernanke as the 4th most powerful individual in the world.

Ben Bernanke (b. December 13, 1953) is the current Chairman of the Board of Governors of the Federal Reserve, the organization that oversees the monetary policy and infrastructure of the United States. Newsweek currently ranks Bernanke as the 4th most powerful individual in the world.

Bernanke began his term as Chairman on February 1, 2006. His predecessor was Alan Greenspan, largely viewed as the iconic face of the Federal Reserve and known as an international mainstay in the financial community. Prior to being appointed to the position by former President George W. Bush, Bernanke was the chairman of the President’s Council of Economic Advisors. He also has a doctorate in economics from the Massachusetts Institution of Technology. Bernanke’s term got off to a poor start during his confirmation, which passed by a vote of 70-30 – historically the smallest margin for any confirmation for the position.

As Chairman of the Board of Governors, Bernanke is the point person for monetary policy in the United States and serves as a key advisor to the President as needed. He frequently represents the U.S. abroad during international summits and impacts global financial operations regularly, as do most other central bank heads, with his commentary and analysis on current events. He is currently on his second term as Chairman, and will seek renewal for a third term in 2014. Bernanke’s term expires in 2014; his term as a member of the Board of Governors expires in 2020.

Bernanke has been blamed by a wide variety of critics for failing to foresee the 2008 economic crisis, and for also strongly advocating the financial bailout in 2008. Supporters claim that his defense of the bailout and subsequent stimulus injections is one of the reasons why the economy has managed to begin a recovery from the recession. One notable event in Bernanke’s term as Federal Reserve Chairman was the quantitative easing measures announced in 2010, designed to stimulate the economy and expand the money supply. This is largely due to his belief that previous recessions, including the Great Depression, were caused in part by government shrinking the money supply.

Under his term, the dollar index has fallen from a rough high of 92.00 to 77.17 (as of March, 2011). The devaluation of the dollar coincided with policies of the Bush administration that sought to lower the relative value of the dollar compared to major currency partners. To respond, Bernanke has advocated keeping the interest rate near historical lows since the beginning of the economic crisis, and has expressed reluctance to raise the interest rate for fear that doing so would weaken a fragile recovery.

There are several key challenges that Bernanke will continue to face throughout the remainder of his term. Chief among these is the impact that the interest rate and quantitative easing will have on the American economy. The value of the dollar is also a pressing concern, since the dollar is near modern lows compared to other currencies. Bernanke will also have to contend with those within government who seek to alter the mandate of the Federal Reserve to remove its focus on creating jobs.

Comments (0 comment(s))