Gold price outlook: the XAU/USD pair is currently consolidating losses after a sharp decline

The precious metal continued a sharp decline last week from levels just above the key psychological mark of $1,300 and remained under some selling pressure for the fifth session in a row on Monday.

The bearish pressure remained unchanged, despite the new wave of global risk-aversion trade caused by the news that China is considering the possibility of suspending business with suppliers who agreed to stop supplying Huawei.

Gold price technical analysis

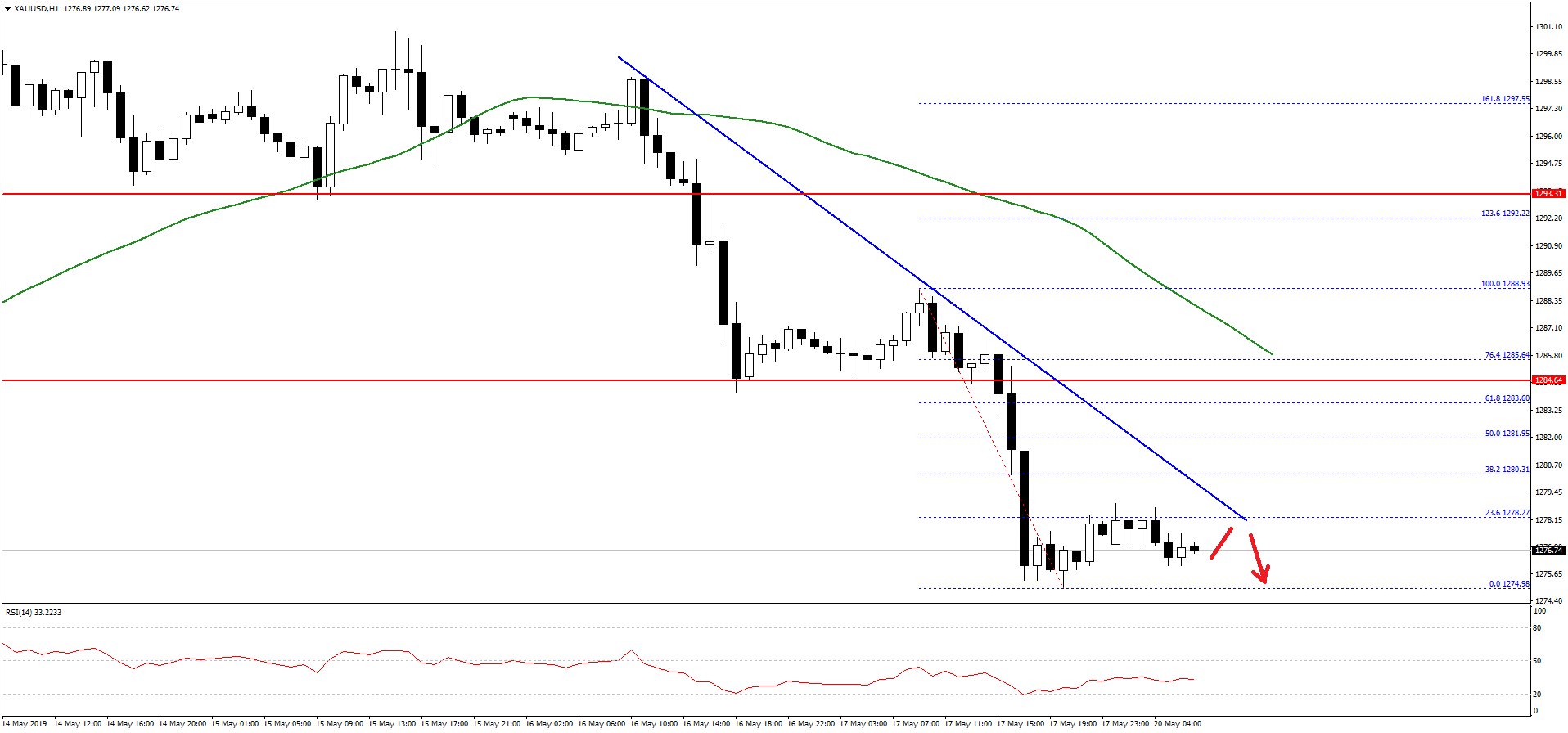

Gold price failed to stay above the $1,295 and $1,294 support levels against the US Dollar. The price started a fresh decline and broke the key $1,284 support level to enter a bearish zone.

The recent decline was such that the price even settled below the $1,284 support and 50 hourly simple moving average. The price traded towards the $1,275 level and a swing low was formed at $1,274.98.

The price is currently consolidating losses, with an immediate resistance near $1,278 and the 23.6% Fib retracement level of the last decline from the $1,288 high to $1,274 low.

There is also a major bearish trend line forming with resistance at $1,280 on the same chart. Therefore, as long as the price is below the $1,278 and $1,280 resistance levels, there is a risk of more losses in the near term.

Comments (0 comment(s))