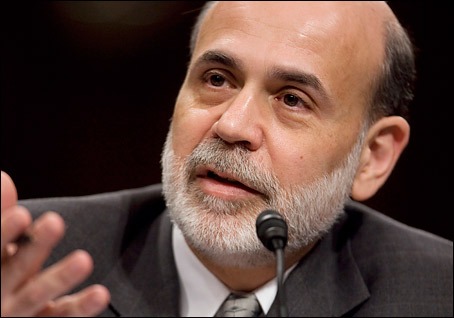

Bernanke Delivers Speech, Addresses Inflation and Defends Asset Purchases

NEW YORK (Forex News Now) – In forex trading news today, Federal Reserve Chairman Ben Bernanke delivered an address on the economy, voicing his concerns on low inflation and commenting on the Fed’s Wednesday announcement of a new stimulus program.

NEW YORK (Forex News Now) – In forex trading news today, Federal Reserve Chairman Ben Bernanke delivered an address on the economy, voicing his concerns on low inflation and commenting on the Fed’s Wednesday announcement of a new stimulus program.

Speaking in Jacksonville, Florida, Bernanke first addressed the $600 billion asset purchase program announced by the Federal Open Market Committee on Wednesday. In his speech, Bernanke stated that the goal of the program was to spur the sluggish recovery of the American economy with stimulus.

“The Federal Open Market Committee voted to buy additional securities in the open market with the goal of providing more stimulus, and we hope bringing about a faster recovery”, stated Bernanke in his speech.

Bernanke has been a vocal supporter of monetary stimulus policy over the past year, citing a need to prevent the economy from slipping back into a double-dip recession and boosting slow GDP growth. Recently – including in today’s speech – Bernanke has gone on the defensive in regards to criticism both at home and abroad of the Federal Reserve’s stimulus program decision.

One criticism is that the purchase plan would drive down the value of the dollar, which has dropped significantly so far in 2010.

Addressing this concern, Bernanke pointed out that the central bank’s primary responsibility is to ensure maximum employment and a favorable rate of inflation.

“The best fundamentals of the dollar will come when the economy is growing strongly,” he said, further adding that “we are certainly aware that the dollar does play a special role in the global economy, in the international financial markets, in the international monetary system.”

The chairman also voiced concerns regarding inflation, stating that inflation was “very, very low, probably below the level that is healthy for the economy in the longer term.” One reason for the low inflation, according to Bernanke, is that commodity prices are surging, with too much slack in the economy.

This forex trading news had little overall effect on the dollar. The U.S. Dollar Index remains positive on the day, up 0.82% to 76.505. The dollar is up 0.69% on the yen, 1.23% on the euro, and 0.42% on the pound.

Bernanke’s comments are not surprising; it is clear that he supports the stimulus program and is open to further expansions of the program in the future. It is also clear that he doesn’t consider rising inflation to be a danger any time soon . In fact, at this point, the chairman would probably welcome rising inflation because it would be indicative of a strengthening economy.

Those following forex trading news for the dollar may be reassured that Bernanke is not actively seeking to weaken the dollar further on purpose, and is accepting a weaker dollar in the short term for a stronger economy – and dollar – in the long term.

See the best UK Forex brokers!

Comments (0 comment(s))