EUR/JPY: Euro faces stiff resistance near 129.00; strong support at its 50 hourly SMA

The cross is extending its multi-session sideline between 128.00 and 129.00 so far on Thursday, always watchful on the Brexit talks, Italian political news, and US yields.

The current rebound in US yields is supporting the upside momentum in USD/JPY and in turn lending support to the cross via a weaker Yen.

In the same line, some optimistic headlines in the Italian political scenario earlier in the session lent extra oxygen to EUR.

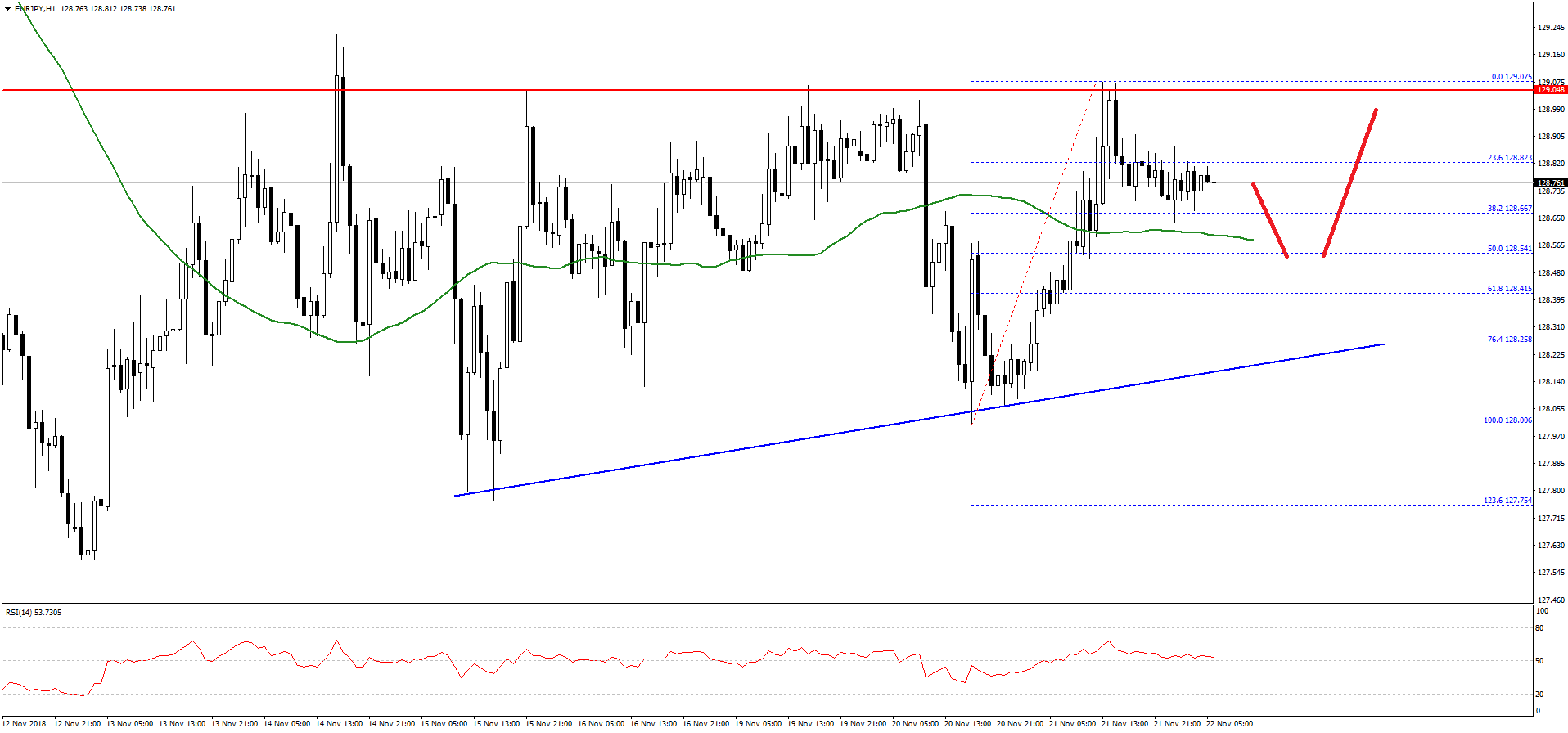

In the meantime, the Euro is facing a strong resistance near the 129.00-129.48 zone against the Japanese Yen. The EUR/JPY pair declined recently and it is currently trading well above the 128.50 support area.

During the decline, there was a break below the 23.6% Fib retracement level of the last wave from the128.00 low to 129.07 high. However, there are many supports on the downside, starting with the 128.60level and the 50 hourly simple moving average.

Below the 50 hourly SMA, the next support is at 128.50 and the 50% Fib retracement level of the last wave. There is also a key bullish trend line in place with support at 128.30 on the hourly chart.

Therefore, dips towards the 128.50 and 128.30 levels remain supported. However, buyers need to clear the 129.00 barriers for a solid upward move in the near term.

Comments (0 comment(s))