Forex major currency pairs forecast for 2018

As we head into 2018, this major currency pairs forecast is crucial for forex traders who need some direction on what to expect. Keep in mind, circumstances change along the way, and these predictions are not carved in stone.

US dollar

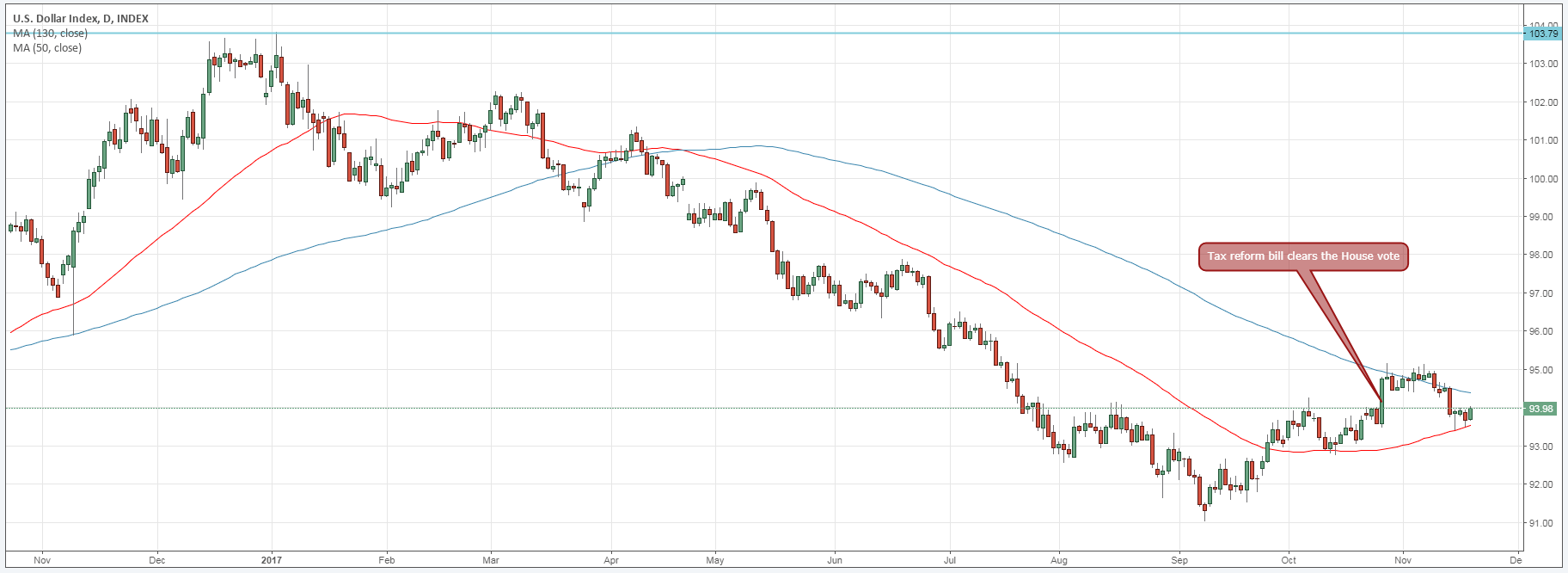

The US dollar registered a lacklustre performance for all of 2017, but it might also have the most promising of the currency pairs forecast in 2018. As soon as the new year began, the US dollar index began to wane. At the start of 2017, the US dollar index was at a 14-year high around 103.79, but now it has declined by 9.45% to 93.98.

However, this currency is poised for upward movement in 2018 after the administration managed to pass a key legislation on tax reform. On the day the bill was passed through the House of Representatives, the DXY gained more than 1.2%, showing how impactful the decision could be. Besides the direct impact of this decision, it also signifies the long-awaited reforms promised by President Trump, which may further strengthen the US dollar.

Besides this, experts are bullish on the US dollar for 2018 considering other currency pairs forecast. Some of them are considered in the following sections.

Euro

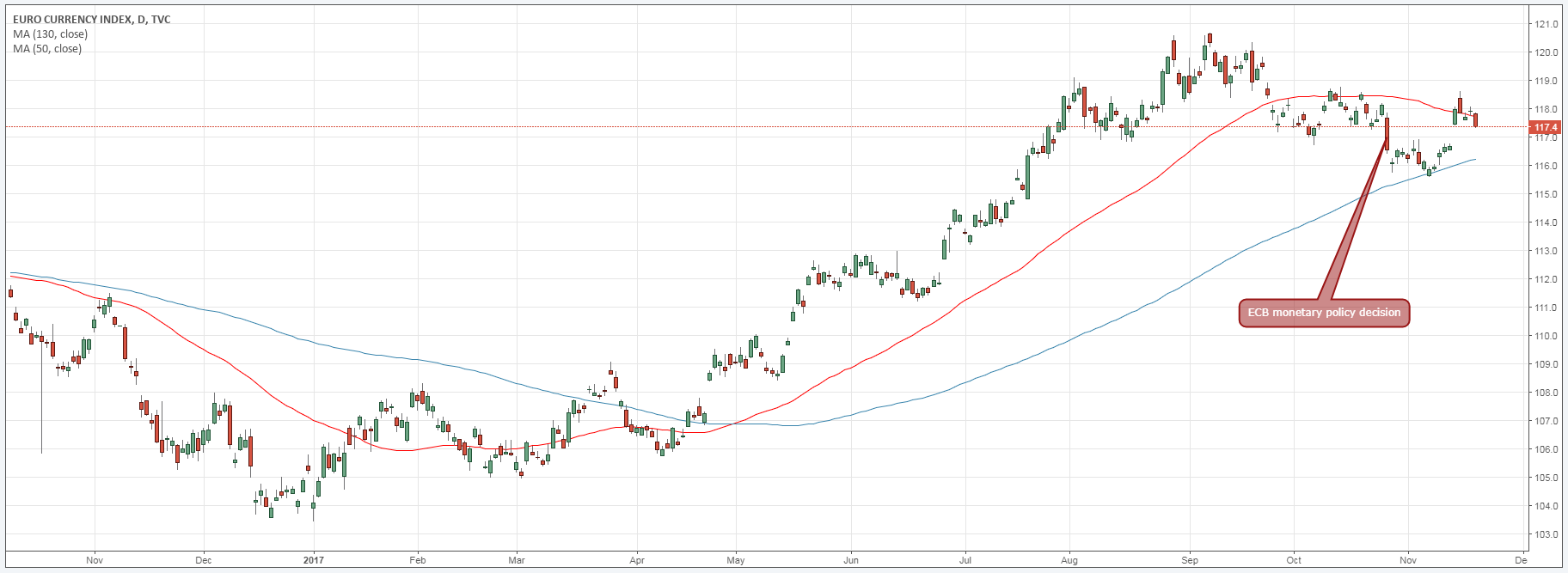

After a year of considerable growth, the uptrend of the euro seems to be finally slowing down. The main driver for the euro’s strength was positive economic performance among EU member nations, especially in Germany. This has not changed, but the ECB’s attitude at the end of October has. Given the already strong economic performance and decreasing inflation, the ECB decided to extend the economic stimulus package into 2018.

GDP growth rate continued to rise to 2.5% in the third quarter YoY while inflation decreased to 1.4% in October down from 1.5% in September. The ECB’s decision thereby caused the euro to weaken, after experts had expected a halt to stimulus packages soon. From this stance, it is expected the euro will continue to diminish compared to other major currency pairs forecast next year.

Sterling pound

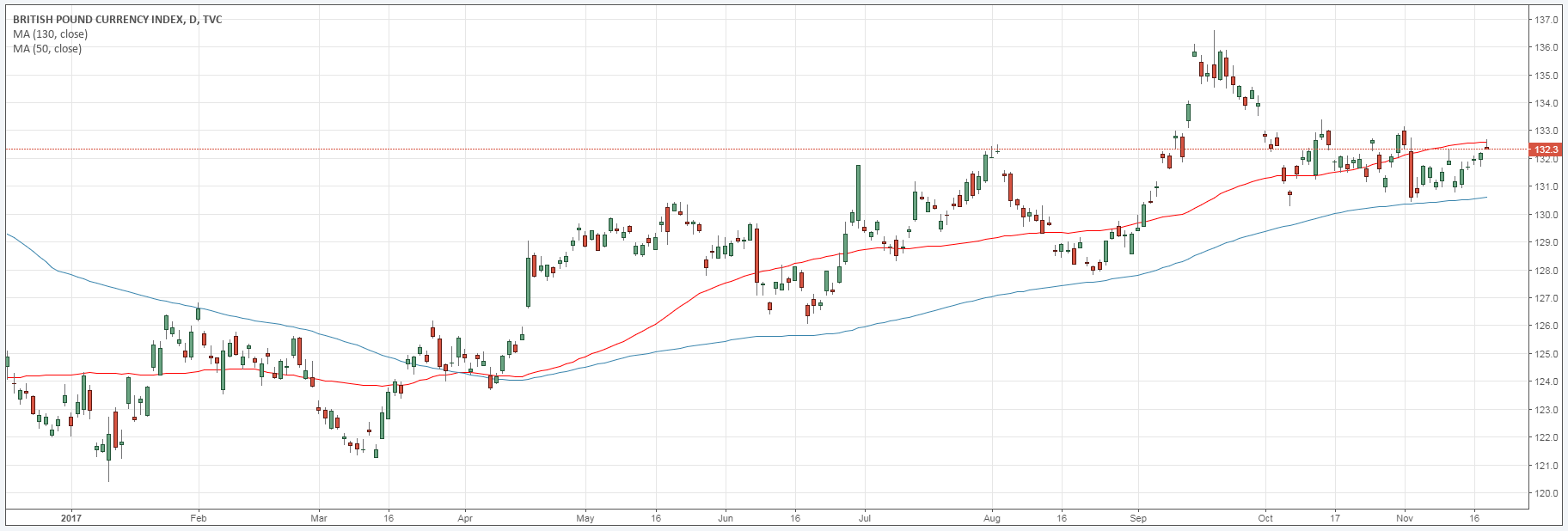

After uncertainty through the first half of the year over Brexit negotiations, Article 50 was finally triggered in April. However, instead of causing the pound damage, the pound index rose and kept doing so for most of the months afterwards. The pound index finally reached a year’s high at around 136.5, before several factors chipped away at it.

Poor economic growth in the retail and industry sectors compounded by Teresa May’s speech on Brexit caused reduced confidence on the currency. When finally the BoE showed a dovish hand, the currency fell further. Compared to other currency pairs forecast, the sterling pound is widely expected to decline in 2018, unless there is a major change.

Comments (0 comment(s))