Forex rigging cartels manipulating the FX market

It is often assumed that the Forex market is too big to manipulate. With a daily turnover upwards of $5 trillion in a day, even the biggest banks cannot manipulate the value of a currency. However, a few players in the market have devised clever Forex rigging techniques that have enabled them to do just that.

How does Forex rigging work?

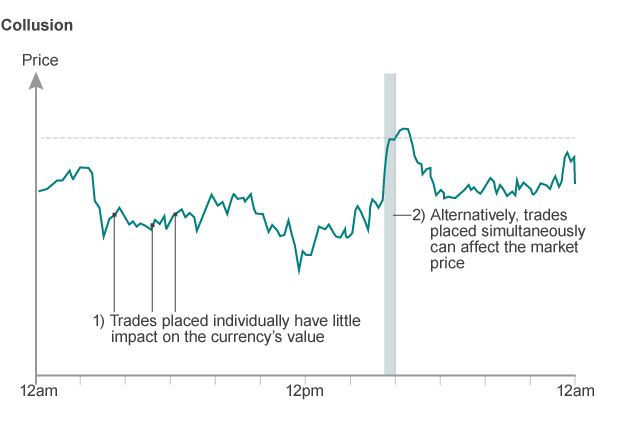

In order to manipulate the value of a currency, you need volume and lots of it. If, for example, there was a billion dollar short position on the US dollar, then the currency would drop in value. Nevertheless, even such a huge position would hardly move the currency’s value, so major players in the market collude to move the markets. By placing huge trades simultaneously, the value of a currency can be moved significantly, with those involved making huge profits in the process.

Collusion in Forex trading

A good example of this was reported by the UK’s FCA last year when traders at HSBC made a $162,000 profit. These traders colluded with, at least, three other firms to short the GBP/USD pair, and the pair’s value dropped from £1.6044 to £1.6009. For a retail trader with a small capital, such a change may not generate a lot of profit, but for the major investors, you can see how that can generate a lot of profit.

Forex rigging is especially common among Forex brokers who have a huge number of clients and can see their client’s positions. This privilege places them at an advantage because retail traders have no idea how many positions have been opened in the markets and to what proportion. When the brokers share their clients’ positions with other brokers, they are also colluding to manipulate the markets. Citi Bank was also found guilty of this by the FCA when its traders attempted to raise the value of the EUR/USD pair, making a good $99,000 profit in the process.

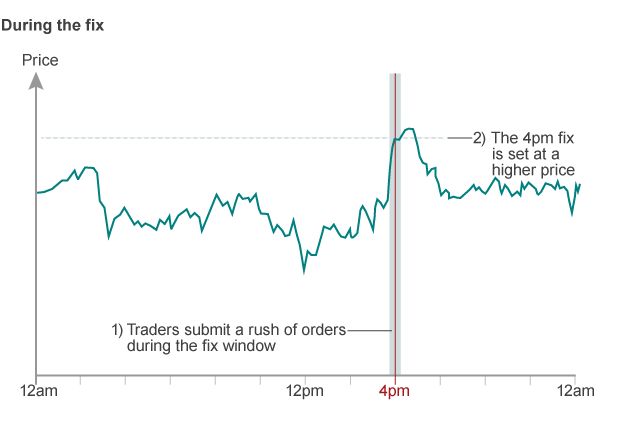

The fix

Another loophole Forex rigging investors use is the 4 pm fix. Since the Forex market is a 24-hour, decentralized market, it is impossible to know how much a currency is in demand. To ‘fix’ this problem, institutions had a 1-minute fix 30 seconds before and after 4 pm London time. During this time, the markets were assessed for supply and demand, then the currencies’ values determined.

Traders who knew this would thus place huge orders during the fix to create a false impression of supply and demand. For example, if huge buy orders were placed for the GBP/USD pair during the fix, institutions would assume the sterling pound was in great demand and value it higher.

When this was discovered, the fix was extended from one minute to five in February so that actual market conditions could be determined.

Who suffers from Forex rigging?

Fortunately, even those involved in Forex rigging are not too ambitious to cause major market moves. Therefore, it could be argued that there is no real harm to retail traders or people who depend on currency exchanges. However, market manipulation can have adverse effects on the market as a whole when people lose faith in the system.

Comments (0 comment(s))