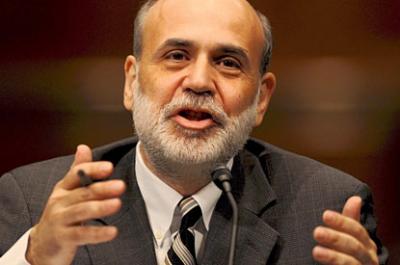

Jackson Hole: Is QE3 Bernanke’s Best Option?

NEW YORK (ForexNewsNow) – Is the Fed ready to inject massive amounts of liquidity into the system again? Many analysts argue that the Fed cannot simply stand by while the US economy continues to deteriorate because of the Debt Crisis. According to calculations by Barclays Bank, market analysts predict that the Fed will introduce liquidity injections of between $500 and $600 billion dollars. In early 2011, Federal Reserve Chairman Ben Bernanke had to revise the forecast of the US economy downwards from a projected a growth of 3.9% to 3.4%. In addition during the first half of the year the U.S. gross domestic product (GDP) grew by less than 1% annually (+0.8%), which was far too low to absorb the rising unemployment rate, which struck above the 9% mark.

Despite the threat of stagnation, the White House has little room to maneuver. Following the Obama administration’s bitter month-long struggle with the Republican-dominated Congress over the Debt Ceiling; the possibility of a new fiscal stimulus is slim. Thus, even despite the downgrade of the US’s debt rating in early August, Washington has few other options than to drastically reduce deficits.

Yet some analysts remain skeptical

ForexNewsNow market analysts do not believe that Mr. Bernanke can go as far this year in Jackson Hole as he did last year. During last year’s economic summit in Jackson Hole, Mr. Bernanke officially announced the beginning of the second round of quantitative easing, popularly referred to as QE2. Yet the results of the QE2 policy remain inconclusive. While the policy did contribute to a short-lived reinvigoration of the US economy and led to a rebound in the stock markets, it also led to the lowering of the dollar in forex markets and drove up the price of commodities. Overall, the results of the policy were not beneficial for the American consumer, which began to see its purchasing power crumble.

In addition the economic environment has changed. In 2010, the Fed justified its introduction of QE2 by arguing that the economy could fall into deflation, while today the trend has reversed. In July, US inflation climbed to 3.6%.

Whether or not Mr. Bernanke introduces a game-changing new policy, the impact on market confidence will be the single most important indicator of the failure or success of this conference

More: How to Profitably Trade During Jackson Hole With Binary Options.

For more exclusive Online Forex News, follow us on Twitter or join us on Facebook.

Comments (0 comment(s))