GBPUSD Technical Analysis

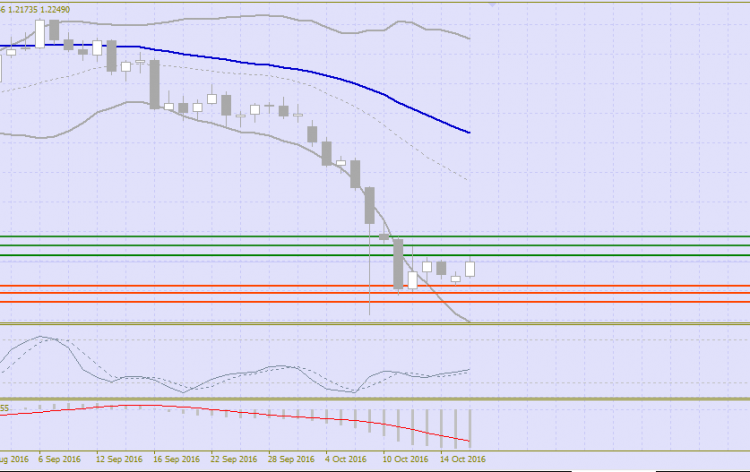

The Cable dropped by 270 points last week as the pair closed at 1.2174. The pair has however shown some bullish sentiment to climb above the 1.2200 level now, as the 50 EMA continues to move negatively both in short term and intraday trading, and the stochastic indicator is now clearly overbought. Seeing all this we can say that the probability of a bearish reversal followed by the resumption of the main bearish trend is very feasible.

The pair started this week with an upward correction after a major fall at the beginning of the month. On the other hand, the USD is gaining some significant momentum from the rising anticipations for monetary policy tightening by the Feds which is expected to happen in December.

Meanwhile, the Sterling is drawing its strength from the expectation of a significant number of important fundamental releases from the UK, these data releases are projected to show growth in their respective indices. The data on consumer inflation is set for release today. As a result of the obvious slump in the GBP, the consumer prices have been estimated to record a rise for the month of September.

With 1.2000 being the next major bearish target, the GBPUSD climbing above the 1.2360 will ease the negative pressure currently mounted on the pair and place the cable on the path to recovery with its target around the 1.2550 region.

The expected trading range for today is between 1.2100 support and 1.2300 resistance.

Expected trend for today: Bearish

Support/Resistance

With the Bollinger Bands indicator placed on the daily chart, you can see an overall bearish slant as the price ranges down and at the same time the range widens at the bottom. The stochastic has turned to buy near the oversold level and the MACD still has a sell signal.

Looking at the indicators, we can watch to see whether the stochastic will turn back down to resume the downtrend till it is in the oversold level or the MACD will reverse to join the stochastic for a buy signal.

Support levels: 1.2132 (local low), 1.2088 (11 October low), 1.1889 (7 October low).

Resistance levels: 1.2272 (local high), 1.2325 (12 October high), 1.2400, 1.2476, 1.2650, 1.2719, 1.2796 (4 October high), 1.2850, 1.2900, 1.2945, 1.3000 (psychologically important level).

Trading Hints

A SELL trade can be opened after the breakout below the level of 1.21335 with targets at 1.20981, 1.20539 and stop-loss at 1.2230.

A BUY trade can be opened after the price settles above the level of 1.2280 with targets at 1.2329, 1.2373 and stop-loss at 1.2240.

Major Macroeconomic Releases for the Pair

Keep an eye on the following events to as they will have the largest impact on the currency pair. The time is in GMT:

- CPI: Tuesday, 8:30 am

- PPI Input: Tuesday, 8:30 am

- RPI: Tuesday, 8:30 am

- Average Earnings Index: Wednesday, 8:30 am

- Claimant Count Change: Wednesday, 8:30 am

- 10-year Bond Auction: Wednesday, Tentative

- Retail Sales: Thursday, 8:30 am

- Public Sector Net Borrowing: Friday, 8:30 am

Comments (0 comment(s))