USD/GEL FX Rate Prediction for 2024

It’s always difficult to predict currency movements due to multiple factors that influence exchange rates, and most of these factors are highly complex, dynamic, and interconnected.

Georgia is a small country with a small economy. Even tinies global events can heavily influence the value of the national currency of georgia: Georgian Lari (GEL). For the past few years, the Georgian economy has seen a lot of challenges and opportunities. The Covid-19 pandemic has hit the Georgian economy as well as the economies of other countries. And Russia’s recent war in Ukraine also heavily impacts Georgians.

The US Dollar is the second most actively used currency in Georgia. While the government tried to De-dollarization the country’s economy, most people use USD to purchase houses and vehicles.

While predicting what will happen to the value of the USD/GEL currency pair in 2024, we need to take into account a lot of factors, such as upcoming elections in Georgia and in the USA, trade balance, GDP growth rate, the increased number of Russian migrants, monetary policies, and more.

Political and Geopolitical Factors that influence USD/GEL

Political and geopolitical factors can be a significant factor in determining currency valuation. Let’s take a look at the upcoming and current events.

Elections in Georgia

At the end of 2024, Georgia is expected to have its parliamentary elections. Keep in mind that Georgia is a parliamentary republic, which means that the upcoming elections are a major political event for the country. And through the whole 2024, there will be campaigns, promises and spending a lot of money.

It is likely that the rate of money spending will increase by the government to win the hearts and minds of the Georgian people prior to the elections, however, it is known that increased spending can cause inflation. It is expected that the upcoming elections will be a negative factor for the strength of Georgian Lari for the 2024.

Elections in the USA

2024 is a year of presidential elections in the United States. Elections can bring changes in the foreign and national policies that will impact the value of the US Dollar. The elections influence essential economic factors such as trade, fiscal and monetary policy, and the US Stance on the ongoing military conflicts. The way campaigns are managed and the results of elections can influence investor sentiment. If the election process and results are perceived as positive for the US economy, it may lead to increased investor confidence and strengthen the US Dollar, and vice versa. At this point, it’s difficult to say how elections will impact the USD.

Prospects for more economic ties between Georgia and EU

Georgia builds more ties with the European Union. Russia’s War in Ukraine has helped this process as many European politicians that were previously against EU expansion, now have changed their rhetoric. Germany among other EU countries is one of the most notable examples. The world’s fourth largest economy in the world after the USA, China, and Japan, Germany has managed to cut its energy dependency on Russia and changed its foreign policy dramatically.

Georgia has been trying to become a EU member for many years, and the country has lots of challenges in this way. Firstly, the Georgian economy is weak, and secondly, there are security concerns. Russia’s ongoing occupation means that Georgians are unable to control 20% of their territory and there are always tensions on the borders with the separatist regions.

In case Georgia gains EU candidate status, it will be a positive sign for the Georgian economy and the GEL value will increase. EU candidate status means that more investors will be interested in producing goods and services in Georgia. As mentioned before, Georgia has a relatively poor population and reduced expenditure on human resources can be a deciding factor for many international companies that aim to serve EU markets to move their production in Georgia. In addition, the candidate status will bring more grants and funds for Georgian farmers, institutions, and businesses from the EU.

Military conflict in Ukraine

Impact of Russia’s War in Ukraine is already felt in Georgia. Russian military aged men fleeing their country to avoid being conscripted end up in countries such as Georgia, Armenia, Kyrgyzstan, Uzbekistan, etc.

The influx of Russian migrants has definitely been a positive factor for the Georgian Lari. The central bank of Georgia increased foreign currency reserves significantly, Lari became more stable, and the investors’ confidence in the Georgian economy grew. Real estate sector in particular experienced one of the biggest growths. Prices on building materials, and property have skyrocketed. However, it should be mentioned that price hikes on property also have its victims. These victims primarily are Georgians that do not own a house and have to rent it, are now facing increased fees.

If the Russian exodus from their homeland continues for 2024, Georgian Lari is likely to keep benefiting from it. Georgia has a land border with Russia, and there are no visa requirements for Russians to enter the country. While it’s true that prices have skyrocketed in Georgia in recent years, the fact that Russians can easily move to Georgia makes the country a popular choice for the migrants.

Monetary Policy

The monetary policy in Georgia is dictated by the National Bank of Georgia (NBG), which is the central bank of the country. While, theoretically, the National Bank of Georgia (NBG) operates as an independent institution, recent events surrounding the Otar Partkhaladze case have raised questions about the practical application of this independence. In this article, we will delve deeper into the implications of these events and their impact on the perceived autonomy of the NBG.

The main goal of any central bank is to control inflation. Inflation is a naturally occurring phenomenon ever since the governments dropped the gold standard and started using the Fiat money. Generally, central banks aim for between 2-4% inflation and it’s important to keep the rates stable. The stability is critical because in chaotic environments businesses suffer, calculations become difficult, planning ahead for the next 5-10 years becomes impossible and as a result, less products and services are created. To counter inflation, the best policy is to help the economy grow. Strong economies can withstand global and international challenges and keep growing. One more popular but damaging tool to the economy that central banks often use is interest rates.

High interest rates are bad for the economy because it makes it more expensive for the individuals and businesses to take out loans, expand their businesses and consume products. Lack of spending results in decreased demand and companies go out of business or reduce the number of employees. Interest rates in Georgia are ranging between 8-12%. For the year 2023, rates were around 11%.

In the US, interest rates at the end of 2023 are around 5.5%, which is record high for the US economy. The US and European countries have had access to cheap money for a long time, which helped their economies grow and strengthen national currencies. However, the era of high interest rates is expected to continue due to global challenges and wars.

Trade and Economic Relationships

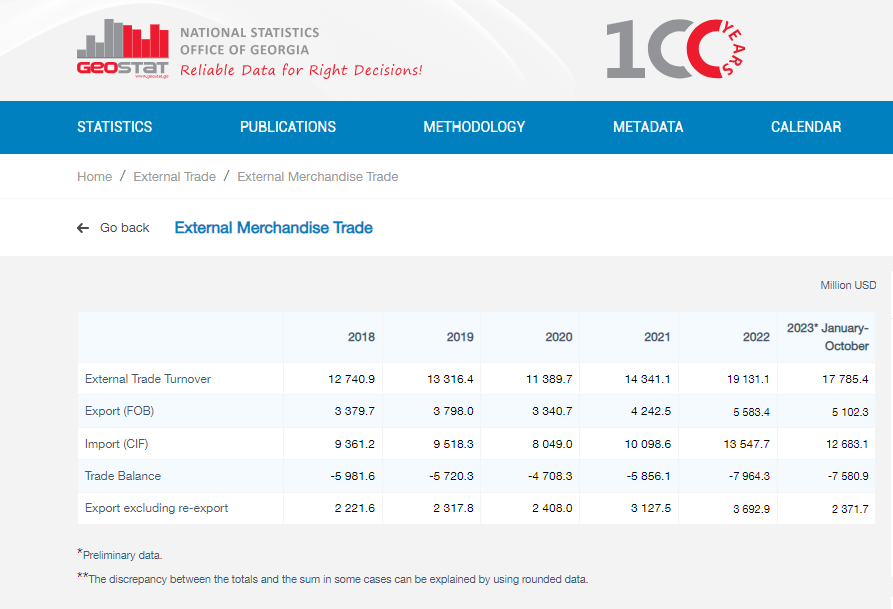

According to the National Statistics Office Of Georgia (GeoStat), according to the preliminary information, in 2023, Georgia’s trade deficit is over 7.58 billion USD. As you can see from the chart below, the trade deficit has been increasing and reached a record number: 7.96 Billion for the year 2022. Georgia is a consumer country and the deficit is likely to remain between 7.5 – 8.5 billion for the following 2024. It should be mentioned that Georgia’s path to EU membership can really turn the country into a producer and improve the trade balance. The huge trade deficit will be a negative factor for the strength of Georgian Lari throughout the 2024.

Transactions from Foreign countries to Georgia

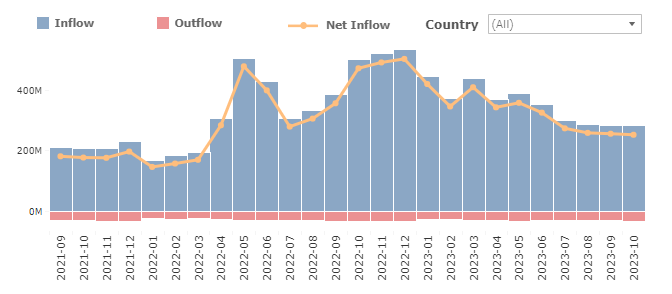

According to the National Bank of Georgia, In October 2023, the volume of money transfers from abroad was 283 USD, which is 219 million dollars (-43.6%) less than the amount in October 2022.

As you can see from the chart, 2022 has experienced a massive surge in transactions and for the year 2023, the amount stabilized. No matter what caused the decrease in transactions, the results will be negative for the Georgian currency if this trend continues for 2024.

Technical Analysis

Now let’s take a look at charts. Keep in mind that analyzing the charts is only one part of the analysis, and fundamentals also need to be considered for the final prediction. Fundamental factors such as economic and political events move the markets, but markets move according to technical rules. Both are important aspects in the analysis to determine what can urge a price to move and how strong that movement can be.

USD/GEL

The Georgian Lari has been traded below 2.71 for the past 2023 against the US Dollar. The pair value even has dropped to around 2.47. According to technicals, it is more likely that the price will remain in that range. In addition, it should be noted that 3.00 is a psychological level for the Georgian Lari. When the price gets closer to that level, the Georgian National Bank tends to sell USD aggressively to keep GEL below that psychological level.

U.S. Dollar Index (DXY)

The US Dollar is a global currency. And its value is influenced by how strong or weak other currencies are. The best index that measures the strength of USD is the US Dollar Index (DXY).

The US Dollar index is calculated by a weighted geometric mean of the US Dollar exchange rate against the basket of other major currencies, with each having a particular weight:

- EUR – 57.6%

- JPY – 13.6%

- GBP – 11.9%

- CAD – 9.1%

- SEK – 4.2%

- CHF – 3.6%

The DXY index rises when the US Dollar exchange rate increases against the other major currencies mentioned above, and it falls when the USD decreases against these currencies.

You can see the DXY chart from September 2020 to the end of 2023 below. The index value for 2023 has been ranging between 98.7 and 109. The chart shows a little bit of uptrend, however, the price seems in range and it’s highly likely that the pink trendline will be broken in 2024 and the price will continue to remain in range, unless political and economical events impact the price.

Risk Factors

There are many risks that can damage the value of GEL and USD. Georgia is a small country and its currency can easily be influenced by global and internal events. While USD is an international currency, it’s more immune to domestic factors.

One of the risk factors for the US Dollar has been alternative currencies such as the BRICS currency and Chinese Yuan. The BRICS (Brazil, Russia, India, China, and South Africa) currency, which aims to challenge USD as the global currency, has been a failed dream and is likely to remain this way for 2024. It’s difficult for these countries that try to replace USD’s dominance succeed, because there are no trustworthy institutions that can be trusted to print money for the rest of the globe. In addition, their goals do not include the world’s biggest economies: the United States, and Europe.

A bigger problem for the US Dollar is the rising debt in the US. For 2023, the debt has exceeded 33 trillion dollars, which is projected to grow through 2023. What makes the situation worse is that the government takes out more loans to service the percentage of the debt.

Partskhaladze case

The Otar Partskaladze case is a very interesting one for a number of reasons. Firstly it shows that the National Bank of Georgia (NBG) is not fully independent from the government, and according to the constitution, the central bank is a fully independent entity, and secondly, it shows that the ruling party is willing to risk the financial stability of an entire country to protect certain influential individuals.

On September 14, 2023, the US State department rolled out its list of sanctions which included former Georgian prosecutor-general Otar Partskhaladze. According to the State department, Russia’s Federal Security Service (FSB) helped Partskhaladze become a Russian citizen and used him to impact Georgian society and politics for the benefit of Russia. The sanctions targeted Mr. Partskhaladze personally, as well as his businesses and wealth.

Following the US sanctions imposed on the former chief prosecutor, Otar Fartskkhaladze, a couple of commercial banks in Georgia have affirmed their commitment to adhering to international sanction regulations. While the Central Bank of Georgia has relieved them of this obligation. The central bank strongly encouraged the banks not to impose sanctions on any Georgian citizen.

Upon Natia Turnava’s (head of Georgian Central Bank) solo decision, as she confirmed, all three vice presidents of the National Bank tendered their resignations. The central bank had to sell close to 100 million US Dollars from its reserves to stabilize the Georgian Lari. However, this particular case was more damaging to the Georgian economy than one can measure in numbers. For the first time over the last few years, the National Bank of Georgia was seen not as an independent entity, but as a government controlled organization.

The Partskhaladze episode and its impact on the Georgian Lari is valuation against other currencies is over by the end of 2023, however, what happens if something similar takes place again and the central bank is unable to show independence? The National Bank of Georgia’s close ties with the ruling party remains a risk factor for GEL for the year 2024.

Final thoughts

Predicting where USD/GEL will be for 2024 is challenging as there are various factors to take into account. We can only make an educated guess. Influx of Russian migrants impacts the value of Georgian Lari positively. In addition, tourism seems to be back to pre-pandemic levels. The Georgian central bank has increased its foreign reserves and Georgia is on its path to becoming an EU candidate country. However, there are negative influences on the economy as well. Government spending is projected to increase as 2024 is an election year in Georgia, Central Banks’ reputation has been damaged by the Partskaladze incident, trade balance negative over 7.58 billion USD, and the transfers from foreign countries have decreased compared to 2022.

On the other hand, USD has its own challenges. The US needs to send aid to its allies in Ukraine and Israel, fight budget deficits, and conduct elections. After taking all these factors into account, we can say that the USD/GEL will remain a volatile currency and its price will range between 2.4 and 3.

Comments (0 comment(s))