What is Forex Scalping?

What is forex scalping?

Scalping is a short term trading strategy employed by some forex traders in which they attempt to go in and out of the market frequently in order to capture small profits.

Although similar to market making in some respects, the scalping strategy is usually executed in considerably smaller size by currency traders operating via online forex brokers. Nevertheless, such smaller traders usually lack the substantial benefit that market makers enjoy of having customers deal on their spreads to help them finance less favorable trading positions.

Although they usually operate via currency brokers in smaller dealing amounts than market makers, scalpers trade the bid/offer dealing spread in a similar way to how market makers trade and generally seek a fast turnaround time on any given position.

Furthermore, while successful scalping simply involves buying low and selling high, very few forex trading strategies seem more challenging and demand as much discipline and concentration of a trader as scalping.

The Best Conditions for Forex Scalping

Forex scalping usually requires an active, “seat of the pants” trading style and constant market monitoring via the best forex broker you can find in terms of their dealing spreads. Basically, dealing spreads must be especially tight and per lot trading commissions very low to nonexistent to make such an active trading strategy as forex scalping worthwhile.

Another helpful condition for successful forex scalping is a liquid currency market that tends to range trade much of the time. Once such a market has been identified, a scalper can use their online forex broker’s trading platform as they attempt to buy near the bottom of the prevailing range and then sell near the top, or sell near the top and buy near the bottom.

Basically, forex scalpers aim to enter and then exit their trades as soon as possible with a net profit in their online trading account. Most currency market scalpers will use technical analysis to help them choose the best entry points and the optimum trading times for the best chance of success in scalping.

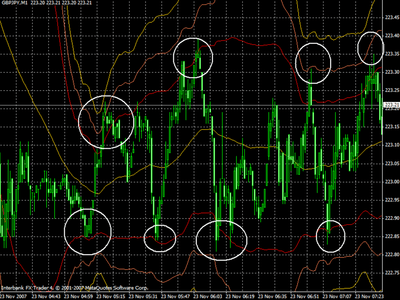

In addition, many forex scalpers focus on the very near term price action, basing their trades on patterns or signals developing on the one, five and fifteen minute charts provided by their online forex broker.

The Optimal Forex Scalper Trading Psychology

Good forex scalpers need to be ready at a moment’s notice to make quick trading decisions and to pull the trigger on an attractive trading opportunity once identified using a price feed from an online forex broker. They also need to be just as ready to get out of the position, whether for a small profit if the market moves favorably or for a small loss if the market moves against their position.

Basically, forex scalpers cannot afford to get emotionally involved with a position. Furthermore, as a result of the high level of trading activity and vigilance required in scalping via online forex brokers, the strategy may not be psychologically suitable for those who prefer a less stressful trading environment.

For example, forex scalpers usually do not include those arm chair forex traders who prefer to analyze a trade thoroughly before establishing a position and placing liquidation orders with the online forex broker of their choice, and then to come back a few hours later while they do other things to see whether the trade was a loser or a winner.

For more exclusive content, follow us on Twitter or join us on Facebook.

Comments (0 comment(s))