SecureKey

The digital world encompasses an increasingly higher number of services as more people are starting to recognize the convenience of having access to various resources through their hand-held devices. The financial sector hasn’t been an exception to this. Banks are starting to focus more on their internet banking services, and there are some who have no physical branches at all. Naturally, the movement of funds is associated with risks such as money laundering and terrorist financing, which is why the government regulates these services tightly, as it requires service providers to authenticate and verify their users. Up until very recently, customers had no problem sharing their personal data with these providers, but as they are becoming more aware of the technology, many are getting concerned about their privacy and security. SecureKey offers solutions to this problem. It is one of the leading providers of identity networks.

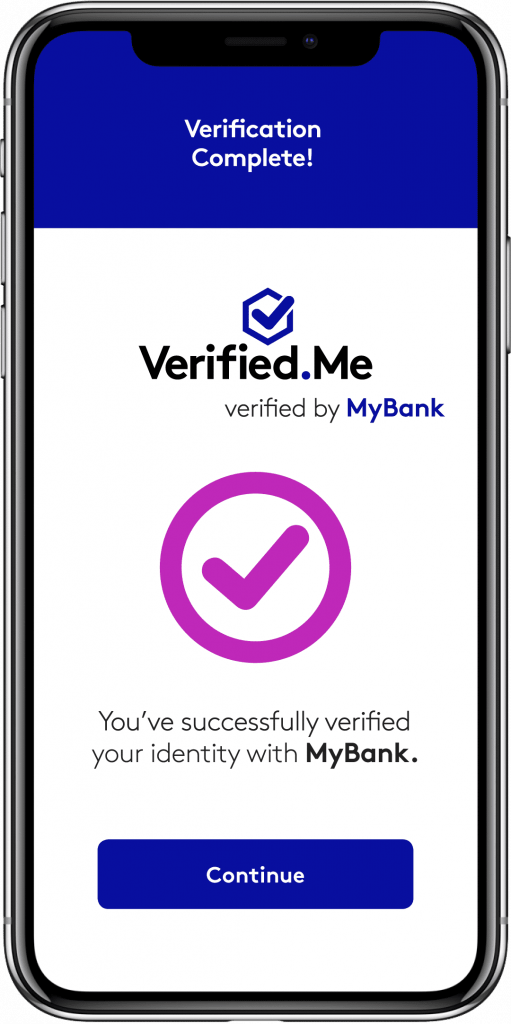

SecureKey offers users a way to verify their identities without compromising privacy

Unlike other services, SecureKey leverages trusted providers including banks, governments and telecommunication companies to allow customers to assert their identity information without having any of the private data shared with the third-party providers without their consent. This is achieved through the use of modern technology like blockchain and through partnerships with established institutions like IBM and Canada’s largest banks. “Organizations such as the Digital ID Authentication Council of Canada, the Command Control and Interoperability Center for Advanced Data Analytics (CCICADA), and many of Canada’s leading financial institutions (BMO, CIBC, Desjardins, RBC, Scotiabank and TD) have been engaged as both investors and partners in the development of this digital identity ecosystem. This unique collaboration will ensure the effective delivery of the new innovation, and improved privacy, security and digital fraud protection for both consumers and service providers across Canada,” – says the company.

Verify.Me is one of the products of the company that should soon become available. It allows users to verify their identities using their mobile devices and trusted providers like banks and the government and later use this verified identity to access services of other providers that would otherwise require users to authenticate themselves manually on their websites. It is part of the Digital Identity Ecosystem and reduces the risk of fraud significantly. The company also offers the SecureKey Concierge service. When customers visit the government service websites that have this functionality enabled, they can sign in using their verified accounts with banks.