Axiory Review – Trade 80+ Products With Regulated Broker

Axiory is a financial trading brokerage primarily focused on the Forex market, although it also offers instruments from other markets as well, including indices, metals, and energies. Founded in 2012, the company has garnered quite a bit of attention, as well as consumer base around the world.

By signing up for Axiory, you’re getting around 80 different financial instruments to trade, and what’s more, you can get quite impressive offerings with these instruments too. The maximum leverage goes higher than an industry standard, the same as minimum spreads. And added to that, Axiory also offers quite a few fund protection mechanisms, including negative balance protection and segregation of funds.

Safety is particularly important at Axiory. The company is based in Belize and regulated by the International Financial Services Commission (IFSC), which ensures that the broker remains loyal to its customers at all times.

In the following review of Axiory Forex broker, our group of expert reviewers is going to take you through every single detail you need to know about this company.

A brief background of the company

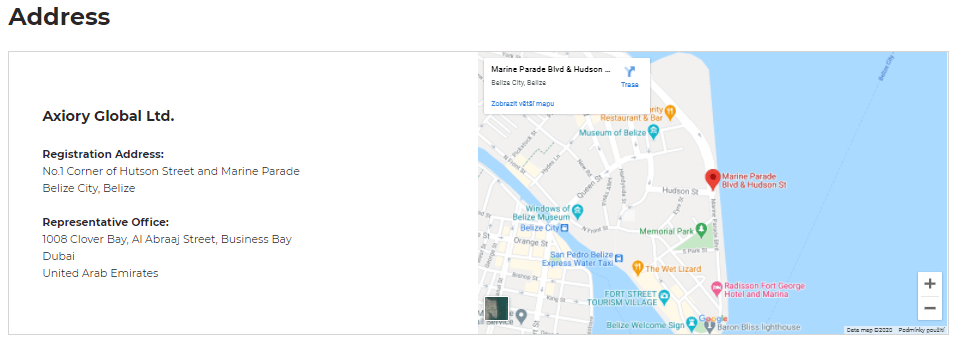

Axiory’s brokerage firm was established in 2012, exactly 8 years ago, in Belize. The registered address is No.1 Corner of Hutson Street and Marine Parade, Belize City, Belize. In those 8 years of existence, the broker has really polished its platform and its offerings.

When searching for any kind of negative coverage in media, our reviewing team wasn’t able to find anything even vaguely damaging to Axiory’s reputation. This is the broker that has a 99.99% success rate of execution, partners with only the top commercial banks, and protects its clients’ funds with complex fund protection programs.

Therefore, by trading with it, you’ll get a trustworthy trading partner in Axiory’s image.

Financial instruments to trade with Axiory

One of the most important features that affect the prestige of a trading firm is the diversity of its tradable assets. And during our Axiory review, we came across around 80 different instruments you can trade online, namely:

- Currency pairs

- CFD indices

- Energies

- Metals

Let’s dive deeper and find out specific details about these instruments.

Forex

As noted earlier, Forex is the primary trading market at Axiory. Therefore, by registering on this platform, you can get over 60 currency pairs from all three categories, be it majors, minors, or exotic pairs.

The currency pairs at Axiory come with quite impressive commission rates. On the one hand, you’re not paying any fixed instrument-related fees by trading currencies, and on the other hand, even the bid/ask spreads are quite low. For instance, spreads on the EUR/USD pair can go as low as 0.2 pips.

As for leverage, you can ramp it up to a whopping 1:777 ratio for your Forex positions, which is quite higher than what other brokers would offer. And as noted earlier in this Axiory broker review, you’re also using the negative balance protection mechanism to prevent your portfolio from ever going below 0.

CFD indices

After Forex pairs, there come 10 different indices that are traded as Contracts for Difference (CFDs). These are some of the most popular stock indices, including the DAX, STOXX50, and NSDQ that bring hundreds of the largest companies together in a single index.

The least spread markup for the CFD indices at Axiory goes as low as 0.7 pips, which is still quite an affordable proposition from the broker. Additionally, you’re also paying the dividend markups, which depend on the type of your position and may either be charged or credited to your account.

Energies

Axiory also offers you 5 different energy commodities. These instruments include different variations of crude oil, as well as natural gas.

The minimum spread markup found during our Axiory broker review was at around 0.4-0.5 pips, which is quite beneficial for commodity trading. And, what’s more, you can use financial leverage to increase your initial capital pretty significantly and generate larger profits.

Metals

And finally, let’s talk about the 4 primary metal commodities that you can trade with Axiory: Gold, Silver, Platinum, and Palladium. All of these metals are represented as financial pairs with the USD, and they too come with pretty impressive conditions.

For instance, the minimum spread goes as low as 1.6 pips, while the standard spread usually revolves around 3-6 pips. As for leverage, you can use a 1:100 multiplication rate for Gold and Silver pairs, and a 1:20 rate for Platinum and Palladium.

So, if you want to invest in products that are considered safe havens in times of uncertainty, you can go ahead and buy Axiory’s Gold, Silver, Platinum, or Palladium assets with pretty lucrative terms and conditions.

Bonuses at Axiory

While reviewing Axiory’s website, we looked for various promotional offerings to the clients but weren’t able to find anything. But it’s not a big deal in terms of forming a substantial Axiory opinion.

That’s simply because while certainly beneficial, promotional bonuses are still superficial additions to the trading platform. Your primary focus point should be the actual trading terms and conditions, as well as safety measures of your broker, whereas various bonuses and tournaments should take a secondary position.

By refraining from offering trading bonuses, Axiory implicitly points out that it’s more important for the firm to provide you with affordable commission rates and higher leverage ratios rather than focusing on fleeting bonuses, which is certainly an advantage.

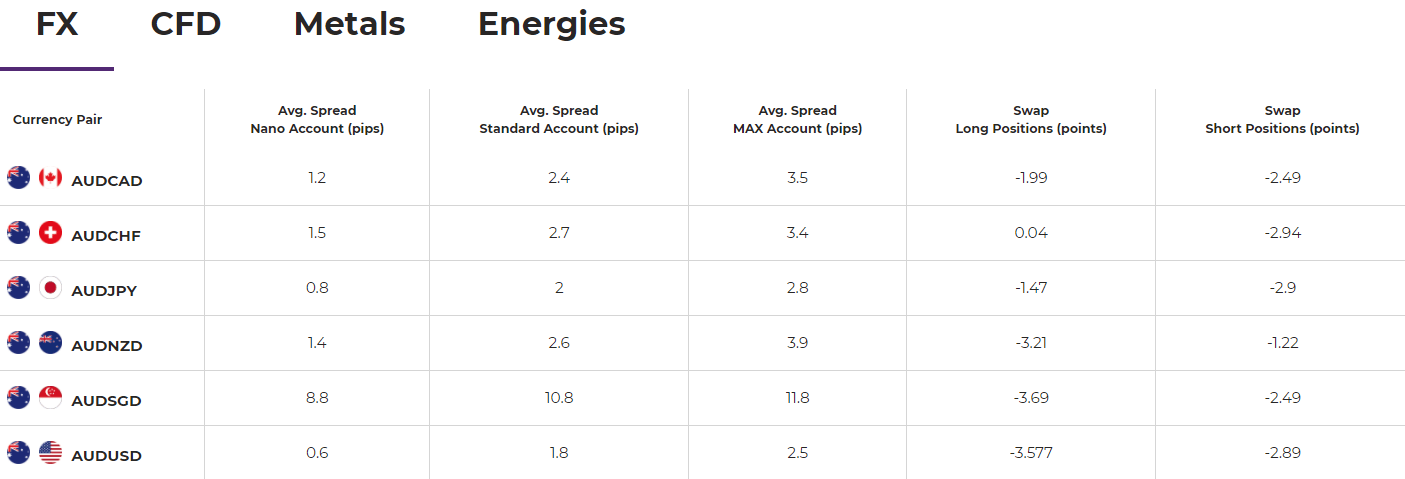

Axiory’s commission rates

Moving on, let’s take a closer look at how affordable the commission rates are at Axiory.

First things first, though, we must acknowledge the fact that no matter which broker you choose, it has to charge you certain types of commissions in order to support its platform. But you still need to make sure that your broker is completely transparent with its commission charges and that it doesn’t bog you with hidden fees.

During our review of Axiory Forex broker, we reviewed all of the existing commissions and came to the conclusion that there are no hidden fees necessary to fund Axiory’s products and services – all of the existing ones are totally enough. And even then, the commission levels are pretty low.

Trading fees

The primary trading fee that you’re going to get by trading with Axiory is a bid/ask spread. Depending on which account type you choose from, you’re going to get different spread markups on the most popular EUR/USD pair. For instance, the Nano account will get you a 0.2-pip spread, Standard – 1.2 pips, and Max – 1.8 pips.

And while spreads are different for individual instrument classes, they’re all still very affordable, especially when you compare them with other competitors’ spread markups.

In addition to the bid/ask spreads, we also found account-related commissions during our Axiory review. But even here, Axiory manages to remain competitive: you’re only paying a 6 USD commission per lot on a Nano account, whereas the other two accounts are totally commission-free.

Yet another trading fee, which is pretty much an industry-standard in Forex, is the rollover swap. You’re either charged or credited a certain amount of swap when you leave your trades open longer than a single day, which is not something you’re going to worry about if you’re a day trader.

Non-trading fees

When it comes to non-trading fees, there’s only so much we can talk about, especially with regards to Axiory who manages to do away with most of the commission charges.

For example, when you’re making deposits and withdrawals to or from your account, you’re not going be charged in the majority of cases. As Axiory puts it, though, there might be some commissions imposed by the payment method provider such as Neteller and Skrill. Plus, the payments – both deposits and withdrawals – below 200 USD will be charged by a 10 USD commission, which is pretty acceptable in our Axiory opinion.

Additionally, there’s an inactivity fee that’s often charged by Forex brokers. However, Axiory doesn’t seem to impose this type of commission on its clients, which is yet another advantage when choosing it as your service provider.

Can Axiory be trusted? – The regulation overview

When looking for a Forex trading brokerage, your primary focus should be on how safe the broker’s platform is. And there’s no better way of finding that out than checking out the broker’s regulatory measures.

The International Financial Services Commission license

When reviewing Axiory, we found out that the broker was founded in Belize in 2012. And as a full-time Belizean brokerage, Axiory features a license from the International Financial Services Commission (IFSC) with the license number 000122/15.

This is a license that regulates lots of financial brokerage firms worldwide. And in addition to being a member of the Financial Commission, which is an institution dedicated to protecting traders’ interests against those of a broker, our Axiory broker review shows that we’re dealing with a trustworthy service provider here.

Fund protection mechanisms

An implication of having an IFSC license and being a member of the Financial Commission is that Axiory is compelled to provide you with a bunch of fund security measures and protect you from not only drastic market fluctuations but also destructive mistakes that you might make.

With that in mind, the broker offers three main fund protection frameworks:

- Negative balance protection – To protect your account balance from ever going below 0 and forcing you to actually pay for the losses.

- Segregation of funds – To make sure your funds are safely stored in separate bank accounts should any financial difficulty strike the company’s finances.

- Compensation of funds – To make sure you’re fully compensated should the broker go bankrupt.

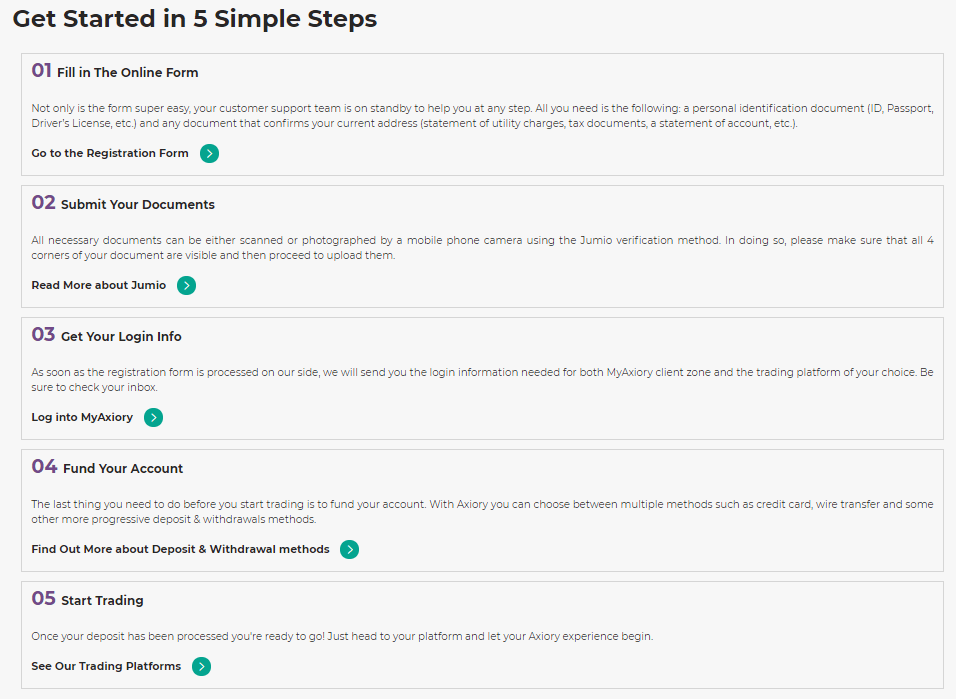

How to register at Axiory?

As you browse through various trading terms and conditions that increase the Axiory rating quite a bit, you might decide to register a live trading account on its platform. And you can create quite a few accounts there, but more about this in the next section.

For now, let’s talk about the registration process itself and find out how simple or difficult it is. As our reviewers personally tried and tested this platform, they pointed out that you can pretty easily sign up for a live account at Axiory. And, what’s more, the process doesn’t even take long to complete.

So, what are the necessary steps you need to take to register on the platform? According to Axiory, there are only 5 steps to complete the entire process, including:

- Filling in an online application form

- Submitting your documents

- Getting your log-in credentials

- Funding your account

- Starting trading

Now, as our Axiory review shows, you only need to provide the most basic details about yourself. These will include your full name, place and date of birth, email address, citizenship, and employment details required by the Jumio verification process.

Under the same framework, you also need to upload two types of documents to verify your identity and residence. For the ID verification, you’ll have to upload the photocopy of either a national ID, Passport, or driver’s license. As for the proof of residence, you can upload either of these documents:

- Utility bill receipt

- Telephone charge receipt

- Commercial bank or credit card company bills

- Residence permit

- Tax-related document

As you verify both your identity and residential address, you’ll be good to go ahead and trade online with Axiory.

Supported countries

One of the main elements of forming the Axiory rating is its availability in various parts of the world. A truly international brokerage should be present in the majority of countries globally.

And in Axiory’s credit, the broker does provide service to the majority of nationalities. With that said, however, there are some restrictions and exceptions from this catalog. For example, as Axiory elaborates, some restrictions might apply to using the broker’s services in 18 countries, including Albania, Iceland, Pakistan, and Uganda.

On top of that, there are countries/organizations that are beyond Axiory’s coverage at the moment, including:

- The United States

- Canada

- EU countries

- The Islamic Republic of Iran

- Indonesia

- North Korea

- Belize

Which accounts can you create at Axiory?

After finding out how you can register and create a live trading account at Axiory, it’s high time to talk about exactly which accounts you can create with this broker. And to the broker’s advantage, there are quite a few to talk about.

In total, there are three live accounts that we found during our Axiory broker review: Nano, Standard, and Max. Here are the details you need to know about each of them:

Nano Account

- Minimum deposit requirement: 100 USD

- Maximum leverage: 1:400

- Minimum spreads (EUR/USD): 0.2 pips

- Account commissions: 6 USD/lot

- Available products: Forex, CFD indices, Energies, Metals

- Maximum order size: 1,000 lots

- The maximum number of simultaneous positions: Unlimited

- Trading platform: MetaTrader 4, cTrader

Standard Account

- Minimum deposit requirement: 100 USD

- Maximum leverage: 1:400

- Minimum spreads (EUR/USD): 1.2 pips

- Account commissions: N/A

- Available products: Forex, CFD indices, Energies, Metals

- Maximum order size: 1,000 lots

- The maximum number of simultaneous positions: Unlimited

- Trading platform: MetaTrader 4, cTrader

Max Account

- Minimum deposit requirement: 100 USD

- Maximum leverage: 1:777

- Minimum spreads (EUR/USD): 1.8 pips

- Account commissions: N/A

- Available products: Forex, CFD indices, Energies, Metals

- Maximum order size: 1,000 lots

- The maximum number of simultaneous positions: Unlimited

- Trading platform: MetaTrader 4, cTrader

Islamic account

Besides the above-mentioned live accounts, we also found out that you can create an Islamic account on the platform, which certainly increased our already high Axiory opinion.

Basically, when you’re trading within longer timeframes, you’re going to be subject to the swap commission charges, which is an interest rate payment. But as you may know, the Muslim tradition is against any kind of interest charged for a service or a product. That goes for credits, dividends, and even overnight trades.

In order to offer more appropriate conditions to its Muslim clients, Axiory provides them with an Islamic account, which is nothing more than a swap-free live trading account. And you can create the Islamic account for all existing account types, be it Nano, Standard, or Max.

Demo account

And last, but certainly not least, there’s a demo account that you can get with Axiory. As the broker elaborates, there are no time restrictions on this account, meaning you can have it for as long as you want.

Plus, there’s a 10,000 USD virtual trading account that refills automatically. This way, and by using all of the elite trading tools and features at Axiory, you can trade just about any available instrument virtually, honing your skills and taking your trading game to the next level.

Execution policy

The next entry in our review of Axiory Forex broker is its execution policy, i.e. how quickly you can place trades and which order types you can use to safeguard them from various risk prospects.

When it comes to the ability to open and close, as well as modify trades as quickly as possible, one can hardly underestimate its value in your profitability. Even just a split second can have a huge impact on whether you generate a profit or inflict a terrible loss on your account, simply because the prices in the market change very quickly.

With Axiory, you’re getting the fastest market execution policy. What this means is that every time you are opening or closing your position(s), the broker delegates your order directly to the market and executes it based on the best available price, so that you’re getting the most benefit.

And when it comes to the available order types, Axiory has it all, whether it’s market orders or stop orders. With these order types, you can further risk-proof your individual positions by setting a specific pip drop/increase that you’re willing to accept. And if the price crosses beyond that line, the trade will automatically close. As our Axiory review shows, the broker does actually care about the safety of its clients.

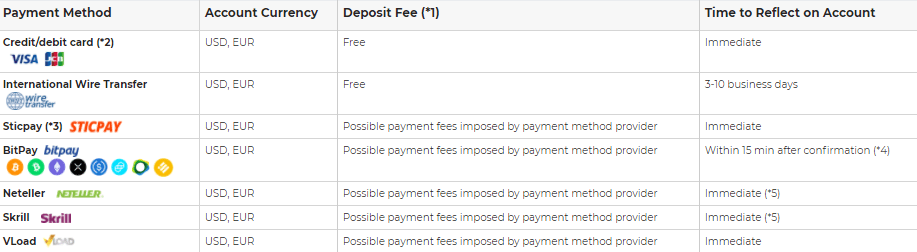

How to make deposits and withdrawals with Axiory

While lucrative trading terms and conditions are undoubtedly very important, it’s also crucial for a broker to provide its clients with the best deposit and withdrawal methods. And by best, we mean fast and secure transactions, as well as convenient deposit requirements and very low commission rates – if not entirely eliminated.

With Axiory, you’re getting all of the benefits one could get from a Forex trading brokerage. First things first, the broker has an affordable minimum deposit requirement set at 100 USD. This entry threshold is accessible for pretty much all retail traders, regardless of their knowledge or experience.

As for the deposit and withdrawal methods themselves, as well as the conditions that accompany them, we have discovered quite a few during our Axiory broker review. These include:

- Credit/Debit card (Visa, JCB) – Base currencies: USD, EUR; immediate transactions; no deposit commissions | 200 USD minimum withdrawal; 3-10 business days; no withdrawal commissions.

- International wire transfer – Base currencies: USD, EUR; 3-10 business days; no deposit commissions | 200 USD minimum withdrawal; 3-10 business days; payment for international remittances.

- Sticpay – Base currencies: USD, EUR; immediate transactions; possible fees from the provider | 200 USD minimum withdrawal; immediate transactions; no withdrawal fees.

- BitPay – Base currencies: USD, EUR; 15 minutes after confirmation; possible fees from the provider | 200 USD minimum withdrawal; 1-5 business days; fees might be charged.

- Neteller – Base currencies: USD, EUR; immediate transactions; possible fees from the provider | 200 USD minimum withdrawal; immediate transactions; fees might be charged.

- Skrill – Base currencies: USD, EUR; immediate transactions; possible fees from the provider | 200 USD minimum withdrawal; immediate transactions; fees might be charged.

- VLoad – Base currencies: USD, EUR; immediate transactions; possible fees from the provider | 200 USD minimum withdrawal; immediate transactions; no withdrawal fees.

So, can Axiory be trusted for the following payment conditions? Being a regulated Forex broker that it is, we can safely say that by choosing Axiory as your main service provider, you’re getting a transparent, as well as a beneficial trading platform with little to no payment commissions and many other advantages.

Axiory’s trading platforms

One of the main purposes of a Forex broker is to provide its clients with a full-fledged trading software full of various tools and objects. Ultimately, such software must contribute to maximizing the profitability in the market, whether it’s Forex, stocks, or commodities.

When signing up for Axiory, you’re asked to choose which platform you’d like to trade with: MetaTrader 4 or cTrader. Both of these pieces of software are extremely popular in the trading market and both are filled with all sorts of beneficial features.

Here are the platform features we found during the review of Axiory Forex broker:

MetaTrader 4

- Execution type: Market

- Available instruments: Forex, CFD indices, Energies, Metals

- Technical indicators and other objects: 50+

- Automated trading: Y

- Social trading: N

- Desktop: Y

- Web: Y

- Mobile: Y

cTrader

- Execution type: Market

- Available instruments: Forex, CFD indices, Energies, Metals

- Technical indicators and other objects: 60+

- Automated trading: Y

- Social trading: Y

- Desktop: Y

- Web: Y

- Mobile: Y

MetaTrader 4

In a wold of Forex trading, no other trading software is more popular or widely-acclaimed than MetaTrader 4. It was created exactly 15 years ago, making it easy for brokers and traders to use a more familiar trading platform.

With Axiory’s MT4, you can get quite a few beneficial tools and features that may not be found with other brokers. For example, a staggering 99.99% of customers’ orders are executed within this platform; there are over 50 native technical indicators, while you’re also able to download thousands of third-party features online, which takes our Axiory opinion to the next level.

cTrader

Then there comes cTrader, which is also a pretty popular trading platform, although not as much as MetaTrader 4. However, there are quite a few advantages that set cTrader apart from its MetaTrader competitors.

First things first, cTrader doesn’t have a hard limit on how many financial products a broker can incorporate in it. That’s why it’s more frequent to see cTrader with stocks and commodity trading, whereas Forex brokers use MT4 more frequently.

On top of that, cTrader has a more modern and sleek design rather than an old-school interface you get in MT4. And you can customize this interface by interchanging between different themes.

As for the features, cTrader comes with more than 60 built-in technical indicators, as well as automated cBots, social trading, and many other beneficial features.

Mobile trading at Axiory

One additional advantage found during our Axiory review is that you can download the mobile versions of both MT4 and cTrader and trade Forex, indices, and commodities with your smartphone. Axiory supports both iOS and Android devices, and its mobile platforms are equipped with pretty much the same features and functionalities, which is always an advantage if you’re on the go.

Conducting research at Axiory

Besides offering a top-down trading platform, it’s also important for a Forex broker to help clients increase their profitability in the market. And one way of doing that is to offer them a bunch of research tools and materials.

Axiory has quite an extensive research department that’s filled with a bunch of different tools, including technical indicators, financial calculators, autochartist, and currency indices.

Technical indicators

One of the most popular and effective ways of predicting future price movements is to conduct technical analysis. Axiory allows you to do just that by offering more than 50/60 technical indicators found during our Axiory broker review.

These indicators include various moving averages, volatility channels, and oscillators. Ultimately, these all help you to analyze price movements that occurred in the past and try to speculate the upcoming price trends. What’s more, there’s also a separate technical analysis section where you can find the expert analyses of the most recent market developments.

Autochartist

Besides building many chart types into its trading platforms, Axiory also features a separate charting mechanism that does much more than passively reflect past price movements. With Axiory’s Autochartist tool, the market developments are automatically observed and analyzed. Then, the software outputs various signals as to when it is beneficial to open or close a position.

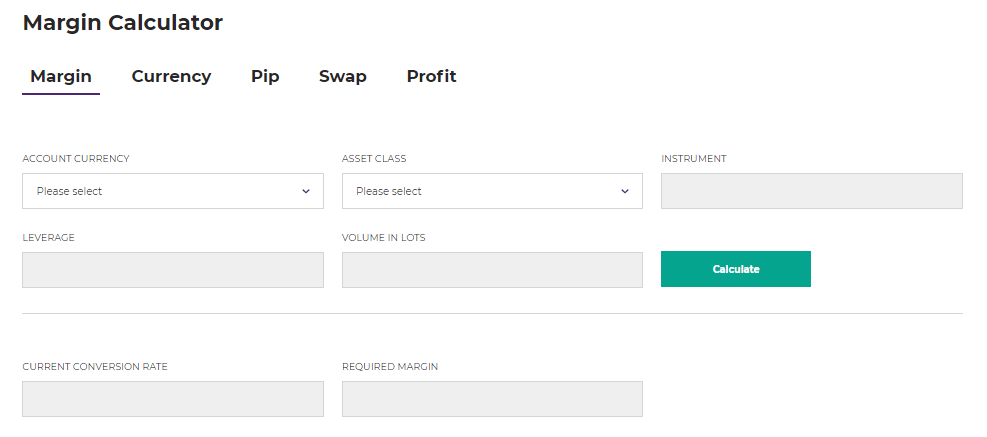

Calculator

When planning or assessing trades, it’s equally important to have an exact estimation of how much you might gain or lose, or how much equity you’re going to spend on one order. As our review of Axiory Forex broker shows, you can use a dedicated calculator tool that lets you turn complicated terms and numbers into more discernible concepts. The broker allows you to calculate margins, currencies, pips, swaps, and generated profits.

Currency Indices

Last, but certainly not least, you can use various currency indices to have a better understanding of specific price fluctuations. A currency index is a combination of the base currency (e.g. USD) and control currencies. It allows you to evaluate how much the base currency has changed – strengthened or weakened – in comparison to the control currencies. This, in turn, can help you to make a more informed decision in the market.

Education at Axiory

As a regulated Forex broker, Axiory is also obligated by the IFSC to provide you with a bunch of different educational materials. And it succeeds at doing so, featuring all sorts of educational articles, online lectures, and expert ideas, not to mention a fully functional demo account.

Trading Academy

The primary educational section found during our Axiory review is the Trading Academy. It is a huge database of educational articles that span across different sections. Currently, the academy includes:

- Basics

- Trading Terms

- Platforms

- Trading Psychology

- Economic Indicators

Each section contains over 10 informative articles that cover all sorts of topics. Ultimately, you can really take your trading game to the next level by reading these articles and incorporating them into your trades.

Online lectures

The next section called Daily Briefing, where you can read insightful market analyses from Forex experts. The next section, Learn to Trade, also contains expert opinions on various financial developments in the world.

Customer Support

As an additional advantage to the platform, a Forex broker must also feature multiple communication channels that allow you to contact the customer support team and get answers on various questions. And our Axiory opinion is finally set as we found a bunch of different support mechanisms on the website.

Here are all of the methods you can use to contact the broker:

- Email support: support@axiory.com

- Phone support: +442031502506 (UK)

- Live chat available on the website

- Headquarters: No.1 Corner of Hutson Street and Marine Parade Belize City, Belize

Each of these methods is useful in its own right. For example, the email support is beneficial for more complex issues, whereas the phone support and a live chat will provide you with the fastest responses from the broker.

It’s also worth mentioning that the website is available in 6 different languages:

- English

- Arabic

- Japanese

- Portuguese

- Russian

- Spanish

Should you trade with Axiory?

As we have discovered in our comprehensive Axiory broker review, this Forex broker has been successfully operating in the market for around 8 years now. And in those years, it has managed to fine-tune its trading terms and conditions.

By signing up for Axiory’s trading platform, you’re getting quite a few benefits that set the broker apart from its competitors. First off, you can trade four different types of instruments at Axiory, including Forex, indices, energies, and metals.

As trading terms and conditions, you couldn’t get more beneficial offerings. For example, bid/ask spreads for EUR/USD go as low as 0.2 pips, while the maximum leverage can go up to 1:777. Additionally, you’re not obligated to pay other instrument-related commissions, which increases your profitability quite a bit.

And if you’re concerned with the safety of the broker, you can rest assured that the IFSC license from Belize, as well as various fund safety mechanisms all work to protect you from sudden market fluctuations or company disasters.

All in all, Axiory is a trustworthy Forex broker that offers you lucrative trading terms and conditions.

Comments (0 comment(s))