DecodeFX Review

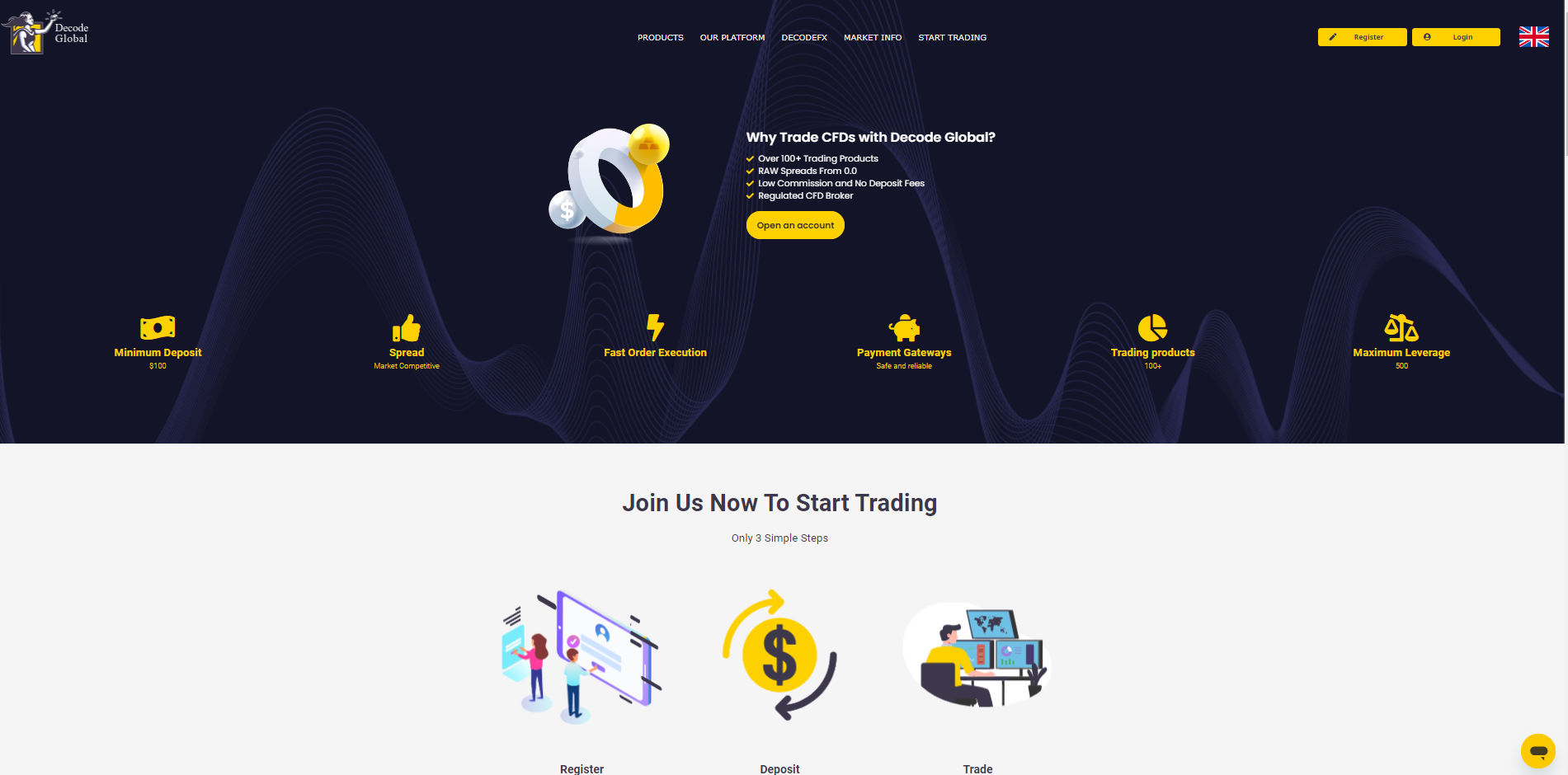

DecodeFX is a financial broker founded in 2004. The broker offers access to trading around 100 different financial instruments, including Forex pairs, indices, and commodities. Traders are provided with a full set of MetaTrader platforms and the customer support is available 24/5 in multiple languages.

Let’s delve into more details about this broker and find out whether it can be a good choice for you or not. We’ll discuss important topics, such as compliance to regulations, available instruments, fees, account types, and funding methods.

Regulatory framework of DecodeFX

When looking for a financial broker to open a live trading account with, the first thing to check is safety. The financial industry is filled with scammers and fraudulent practices.

DecodeFX is a trustworthy broker, because it’s regulated by an international regulatory body. The broker has a license from Vanuatu Financial Service Commission (License No. 700415), however, it should be noted that the regulator is not top-tier.

In addition to being regulated, the broker was founded in 2004, and has been around approximately 20 years already, which adds another layer of safety.

DecodeFX account types

In general, market speculators are grouped in two categories: more active traders, such as intraday traders, scalpers, High Frequency Traders (HFT), news traders, and algorithmic traders. And there are less active traders such as: swing traders, and position traders. Each group of traders have different requirements. In particular, active traders are looking for account types that offer low trading spreads, while less active traders are seeking accounts with no commissions.

Luckily, DecodeFX offers traders both account types, let’s take a closer look at each one.

STD account

The STD account is best suited for less active traders. There are no commissions and spreads on Major pairs such as EUR/USD start from as little as 1 pips. Maximum available leverage is 500:1 on this account and traders can open STD accounts from 100 USD initial deposits.

PRO account

Pro accounts are for active traders. There are no spread markups on this account. And the broker makes money from commissions. Roundturn commission per traded lot is 7 USD. Similarly to the STD account, maximum available leverage is 500:1, and traders can open Pro accounts with 100 USD minimum initial deposits.

It should be mentioned that 1 pip markup and 7 USD commission is not actually cheap compared to the competitors. Most other brokers have lower fees.

DecodeFX available assets

There are over 100 trading assets available for traders at DecodeFX, including:

- 35 currency pairs with maximum available leverage of 500:1

- Over 10 Indices – maximum available leverage 100:1

- And popular commodities such as gold, silver and crude oil – with up to 500:1 leverage

Trading fees depend on the account type and traders can choose between paying spread markups and paying commissions. It should be noted that most competitor brokerages offer a much wider pool of assets.

Trading platforms of DecodeFX reviewed

Trading platforms play an important role in the overall trading experience. They help traders conduct technical analysis, and place various order types. In addition, trading platforms are crucial in social/copy trading, strategy testing, demo trading and performance analysis. DecodeFX offers its traders some of the most popular MetaTrader platforms. And while both platforms are built by the same company, MetaQuotes, and have a lot in common, these platforms are wildly different from each other.

MetaTrader 4 (MT4)

MT4 first appeared in 2005 and instantly became a hit. The platform is still super popular even today. The main advantages of using this platform is that it’s simple to use, and highly reliable. The platform has the widest pool of custom-made trading algorithms available in the MetaMarket. These algorithms are called Expert Advisors (EAs) and help traders automate their trading activity. MT4 is mainly utilized in currency trading, the platform is not built for stocks.

MetaTrader 5 (MT5)

MT5 was released in 2010, 5 years after the release of MT4. MT5 provides traders with enhanced features. And the platform supports various asset classes in addition to currencies, indices, commodities, and crypto, traders can access stocks, bonds, and futures as well. On the downside, MT5 is more complex than MT4.

Let’s take a look at the comparison table for more information.

| Platform | MetaTrader 4 | MetaTrader 5 |

|---|---|---|

| Supported markets | Forex and CFDs | Forex, futures, stocks, bonds, and options market |

| Technical indicators | 30 | 38 |

| Graphical objects | 31 | 44 |

| Timeframes | 9 | 21 |

| Pending order types | 4 | 6 |

| Partial order fill policy | No | Yes |

| Built-in economic calendar | No | Yes |

| Fund transfer between accounts | No | Yes |

| Programming language | MQL4 | MQL5 |

In addition to desktop versions of MT4/MT5, mobile and web trading platforms are also available, which adds convenience to the trading experience.

Deposit and withdrawal options at DecodeFX

The broker enables traders to use various deposit and withdrawal options with zero transfer fees. However, while the broker doesn’t change any fees from its end, when using the bank wire method, intermediary banks may charge you a withdrawal fee. Other funding options are free and much faster than the wire method. Available funding methods are: UnionPay, Wire Transfer, crypto payments, Neteller, and Skrill.

So, Should you open a live trading account with DecodeFX?

To sum it all up, DecodeFX is a legit broker as the company has a license from Vanuatu. However, trading fees are above average, and tradable instruments are very limited compared to industry leaders. As an upside, traders can access a full set of MetaTrader platforms, are offered two account types, and a 25/4 live chat option with customer support agents is available from the broker’s main page.

Comments (0 comment(s))