A definitive and full Inveslo Review

In this review of Inveslo broker, we will dig deeper into the critical aspects of the broker including safety, fees, spreads, accounts, platforms, and extra features. The broker is based in Kazakhstan and only has a local regulation, which is not enough. Spreads are high and accounts offer similar terms with little differences. Educational resources are decent, while many other services are not sufficient to recommend Inveslo to our readers. Ensure to read this review till the end to reveal all critical aspects of this broker.

Inveslo Forex broker overview

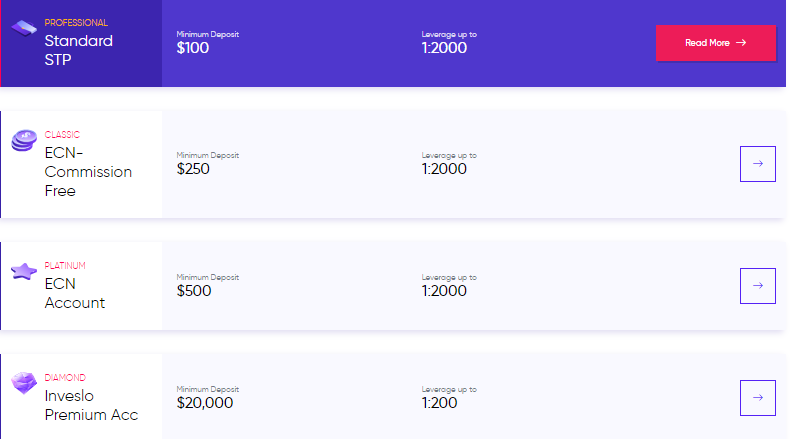

In this quick overview of Inveslo, we will be touching on the most critical aspects of the broker including safety, fees, accounts, spreads, assets, support, and more. The broker offers four different account types, Standard STP Account, ECN-Commission Free Account, ECN Account, and Inveslo Premium Account. All trading instruments offered are in the form of CFDs.

Inveslo Demo account

Inveslo provides a free demo account, which is very useful for testing the actual spreads offered by brokers during live trading. The demo account comes with the same leverage of 1:2000 and 10,000 USD virtual funds to test trading strategies or acquire trading skills. All trading assets are offered on the demo account including Forex pairs, cryptos, indices, and commodities. The trading platform is MT4 web trader for the demo account also.

Inveslo Standard STP Account

The minimum deposit requirement for the Inveslo Standard STP account is 100 USD, which is considerably higher than what popular brokers usually offer. The base account currencies supported for the standard account include the US dollar, and Euro. The spreads are expensive from 2.1 pips, which is noticeably higher than the industry average of 1 pip. There are no trading commissions charged for each 100k traded and the minimum lot size allowed is 0.01 lots or 1,000 USD. The account comes with the option for an Islamic variant for Sharia law followers. The margin call is set at 80% and stop-out will occur at 50%.

Inveslo ECN-Commission Free Account

The second account type is called ECN-commission free account, which does not offer much better specs than the standard accounts. The minimum deposit starts at 250 USD, maximum leverage is set at 1:2000, and spreads are slightly lower but still expensive from 1.9 pips on major pairs, and there are no trading commissions per 100k traded. The margin call and stop-out levels are also 80% and 50%, and the minimum lot size starts from 0.01 lots.

Inveslo ECN Account

The ECN account has a minimum deposit size of 500 USD, spread from 0.1 pips, but charges commissions of 3 USD per lot per side, or 6 USD round turn per 100k traded. The minimum lot size is 0.01 lots and the same stop-out and margin call levels are set. The leverage is also 1:2000 similar to the other two accounts. The 500 USD minimum deposit requirement is expensive, as competition brokers usually offer ECN accounts with 0 spreads for much lower deposits.

Inveslo Premium account

The Inveslo Premium Account starts from a 20,000 USD minimum deposit. It has almost similar specs as the ECN account, except the leverage is lower at 1:200 and has zero trading commissions.

Inveslo Deposits and Withdrawals

Deposits are instant and withdrawals will be processed between 1-2 business days. There are no fees charged for deposits or withdrawals. There is one suspicious claim by the broker. It promises instant wire transfers, which is not possible as this payment option typically takes 2-5 business days.

Inveslo Education, Indicators, and Tools

Inveslo Education, Indicators, and Tools

The one section where the broker is decent is the educational part. It offers a multitude of resources including video tutorials, video guides, webinars, articles, and even e-books. There is also a Forex glossary and numerous other helpful guides. The broker explains critical trading concepts including technical and fundamental analysis, trading strategies, and many more.

Inveslo Additional Features

Inveslo only offers MT4 web traders, which is inferior to the standard MT4 platform for desktops. This is another serious downside of this broker, as traders won’t be able to use trading robots and the platform is slower than on a desktop.

The broker offers Forex pairs, indices, cryptos, and commodities for trading. There are no stocks.

Inveslo has copy trading services and allows EAs in theory.

Inveslo Safety and Regulations

Inveslo is based in Kazakhstan and is registered and regulated by the Central Bank of the country. Since this regulator is not very strict and reputable, we assume the broker is not as safe as other regulated brokers. The comments on the FPA are negative, indicating a possible scam going on. The broker seems to decline withdrawals and even delete profits made in trading. This can be a serious red flag. The broker should be using segregated accounts for client funds, but because of less strict regulations, it is not possible to confirm it.

Customer Support

Customer support from Inveslo includes live chat, email support, and hotline support. The two languages for both support and website are English and Arabic. The FAQ section offers answers to the most commonly asked questions about the broker.

Conclusion

Inveslo has several red flags for having very few regulations, offering instant wire transfers, and only providing a web trader version of MT4. The broker lacks severely in mobile trading as well. The only thing where it shines is educational resources.

We do not recommend the broker, as there are much better alternatives in both low spreads and reputable regulations.

Comments (0 comment(s))