OnEquity Forex Broker Review

OnEquity is an offshore-regulated Forex and CFDs broker that does not provide a live chat support option. The broker offers MT4 and MT5 advanced trading platforms and offers several account types. However, spreads are high from 1.5 pips unless the trader wants to deposit 5,000 USD for 0 pips spreads on major pairs. Negative balance protection is offered for all retail accounts, and there is an Islamic account type offered for each account type.

The broker is overseen by the Financial Services Authority Seychelles, which allows it to offer excessive 1:1000 leverage for Forex pairs.

OnEquity Overview of the website

The website of OnEquity, while a bit overcrowded, still works fast and offers the ability to find all important information. Navigation is very intuitive and user-friendly and the broker would be a good recommendation if not for offshore regulations, lack of live chat, and expensive minimum deposit and spreads.

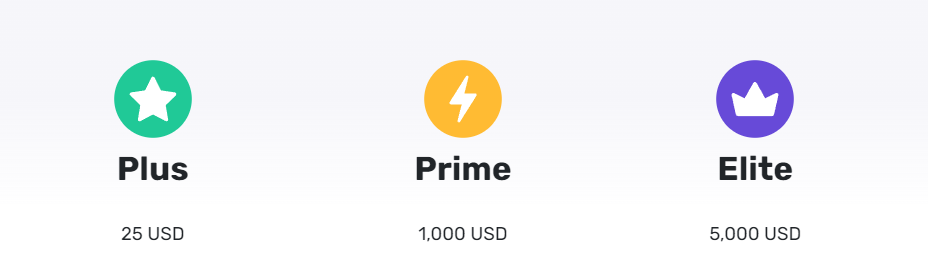

OnEquity Accounts Reviewed

OnEquity broker offers numerous account types including Prime, Plus, and Elite. These accounts have different conditions to offer different spreads. The plus account which is the equivalent of a standard account has a 25 USD minimum deposit requirement and spreads start from 1.5 pips which is expensive. Many reliable brokers we have reviewed offer much lower spreads with the same or lower minimum deposit.

OnEquity Plus Account

The Plus account from OnEquity has the following conditions:

- Minimum deposit — $25

- Typical spreads on EURUSD — From 1.5 pips

- Account base currency — USD, EUR, JPY

- Maximum allowed leverage — Up to 1:1000

- Commissions per lot — 0 USD

- Trading platforms — MetaTrader 4, MetaTrader 5

- The number of instruments — Over 300

- Minimum lot size — from 0.01 lots

- Negative balance protection — Yes

- Islamic account variant — Yes

OnEquity Prime Account

OnEquity Prime accounts have the following specs of spreads and deposits:

- Minimum deposit — $1,000

- Typical spreads on EURUSD — From 0.4 pips

- Account base currency — USD, EUR, JPY

- Maximum allowed leverage — Up to 1:1000

- Commissions per lot — 5 USD

- Trading platforms — MetaTrader 4, MetaTrader 5

- The number of instruments — Over 300

- Minimum lot size — From 0.01 lots

- Negative balance protection — Yes

- Islamic account variant — Yes

OnEquity Elite Account

The Elite account by OnEquity broker has the highest minimum deposit requirement:

- Minimum deposit — $5,000

- Typical spreads on EURUSD — From 0.0 pips

- Account base currency — USD, EUR, JPY

- Maximum allowed leverage — Up to 1:1000

- Commissions per lot — 5 USD

- Trading platforms — MetaTrader 4, MetaTrader 5

- The number of instruments — Over 300

- Minimum lot size — From 0.01 lots

- Negative balance protection — Yes

- Islamic account variant — Yes

Deposit and withdrawal options at OnEquity

Deposits and withdrawals at OnEquity are offered without commissions, and there are several methods accepted for payments. These methods include bank cards, wire transfers, and various e-wallets including Skrill, Netteler, and more. Deposits are processed within 30 minutes which is an unusually long time and a red flag. All other brokers make deposits instant and OnEquity makes it difficult to even deposit funds not to speak about lengthy withdrawals. Definitely a serious red flag and inefficiency here.

OnEquity Assets — What can you trade?

OnEquity offers access to several trading asset classes such as Forex pairs, commodities, indices, stocks, and cryptos. All assets are offered in the form of CFDs. The leverage is capped at 1:1000, allowed by Seychelles FSA, the main regulator of the broker. This high leverage makes it simple for novices to blow up their accounts and is not recommended for beginner FX traders. Offshore regulation with this high leverage is a red flag for sure. Popular indices are offered including NASDAQ 100, and GER40. The broker also offers US, UK, and EU stocks for trading. There are 40 Forex pairs in total. As for the crypto CFDs, OnEquity offers 15 instruments from popular cryptos.

Trading platforms of OnEquity

The broker provides access to advanced platforms MetaTrader 4, and MetaTrader 5. Both MT4 and MT5 platforms by OnEquity offer advanced charting and technical analysis capabilities including the full support of custom indicators and automated trading robots (EAs). There are also mobile trading apps offered for both platforms. All devices are supported including Desktop and mobile together with support for web traders. Android and iOS apps can be downloaded from the broker’s website or corresponding app stores. Mobile apps offer a multitude of built-in technical indicators but are still inferior to desktop versions. With MT4 and MT5 mobile apps, traders can access markets from anywhere in the world which is inherent to these apps.

Education at OnEquity

OnEquity provides little to no very unfortunate trading education. There is a trader glossary that can not be used as a substitute for trading education. There are no trading courses, webinars, or video educational content offered. The broker has several market research tools available including an economic calendar and several calculators. Overall, OnEquity falls short in the educational section and needs serious improvements after safety adjustments.

OnEquity Customer Support

OnEquity customer support experience is mediocre as the broker offers hotline and email channels but lacks a live chat. This is a serious red flag that cannot be underestimated or overlooked. Live chat is the best support option and without it, the broker does not seem like a serious company. The website is multilingual which is good but support needs serious attention in its current form.

OnEquity bonuses and promotions

The broker offers welcome bonuses periodically. OnEquity lacks any promos and discounts but offers daily technical analysis, weekly outlooks, market news, an economic calendar, a trader glossary, and more.

Is OnEquity your broker? Final verdict

OnEquity makes a pitiful attempt to position itself as a competitive choice for traders who are interested in Forex and CFDs but fall short in providing enough assistance alternatives. To receive competitive spreads, traders must deposit a minimum of $1,000 and the broker lacks live chat also. The standard account has 1.5 pips spreads which is super expensive. Even with only 0.4 pip spreads and a 5 USD charge, the 1000 USD trading account is still costly to run. Depositing 5,000 dollars to receive 0 pip spreads is not a good offer by any means as many brokers are more reliable and offer low spreads at much lower minimum deposits, making OnEquity a much worse choice.

FAQs on OnEquity broke

Is OnEquity a legit good broker?

OnEquity’s high leverage and lack of live chat support raise reliability concerns, despite being regulated by the FSA of Seychelles.

What can I trade at OnEquity?

You can trade Forex pairs, commodities, indices, stocks, and cryptocurrencies as CFDs. Over 40 Forex pairs and 15 cryptocurrencies are available

What is the minimum deposit at OnEquity?

Minimum deposits are 25 USD for the Plus account, 1,000 USD for the Prime account, and 5,000 USD for the Elite account.

Comments (0 comment(s))