Is Trade.com legit Forex broker?

TRADE.com is one of the most remarkable representatives of the CFD trading industry. It has built a name for itself and a strong reputation for integrity, excellent offering and product. Founded in 2013, TRADE.com is delivering its services from the main office located in Nicosia, Cyprus. The website is owned and is being operated by Trade Capital Markets (TCM) Ltd CySEC regulated and by Livemarkets Limited which is FCA regulated.

Is Trade.com legit? This question is asked frequently, although Trade.com is a fully legit business. The brand is operated by TCM Markets and Live Markets which are both regulated (CYSEC and FCA respectively) plus by the FSCA in South Africa. Additionally, the safety of clients’ funds is the priority for this company. That is why Trade.com offers a segregated account feature.

Trade.com Review: Account Types

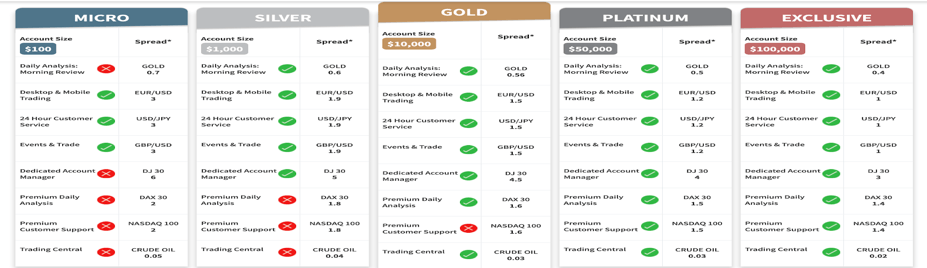

To ensure the best quality of trading even for a very demanding customer, Trade.com offers different account packages. Our Trade.com review identified a selection of different types of trading accounts for CFDs at this broker. Account minimum deposit starts at just $100 for the micro account and conditions get better as you work your way up the account types.

Although it is worth noting that they offer many more products in addition to CFDs. This includes Direct Market Access trading of over 100,000 global assets at best price execution, access to IPO allocations. Thematic trading and even asset management plus spread betting for UK and Irish clients.

Besides great live trading accounts, Trade.com allows testing the platform with the help of the free demo account.

Trading Platforms

Trade.com Forex broker provides two trading platforms for all the registered users. These are:

- Trade.com WebTrader

- Trade.com MetaTrader 4

- MT4 mobile app

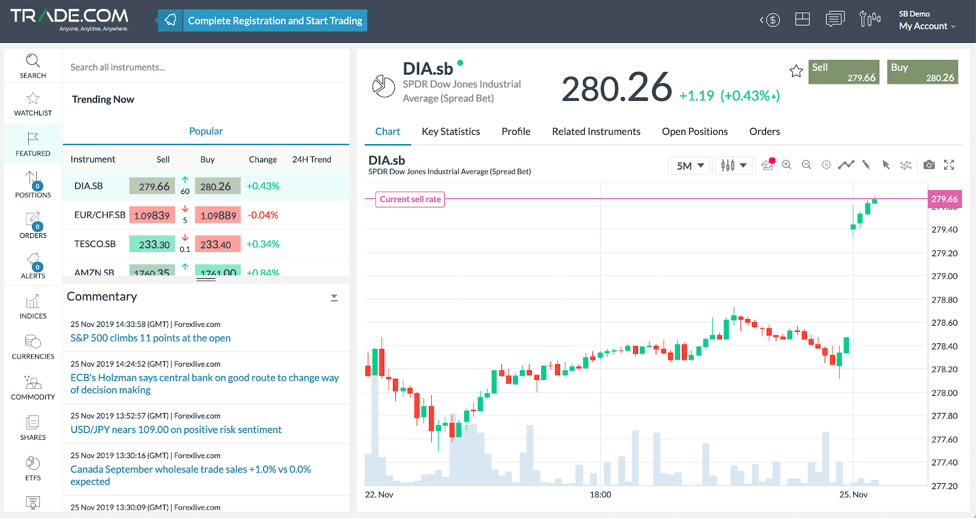

The WebTrader, as the name implies, does not require the trader to download any software. The user receives access to more than 2,000 trading instruments via the browser. Trade.com WebTrader has simple navigation, advanced charting package and tons of technical indicators. It is also worth mentioning that WebTrader is fully supported by Android and iOS devices. This allows trading on the go.

To launch MetaTrader 4, the user has to install the software. Just like WebTrader, Trade.com MT4 grants the trader access to hundreds of assets, including Forex, CFDs, Stocks, Indices, Commodities, Bonds, cryptos and now even Cannabis based assets. On top of that, the platform allows users to benefit from automated trading, embedded tick charts, and alerts on trading positions.

Trade.com Opinions: Spreads and Leverage

Spreads at Trade.com are fixed and start from 0.4 pips for gold for the institutional account size for gold trading. The spreads increase as you move down towards the micro account.

Trade.com allows increasing the size of the position by utilizing the leverage. Usually leverage is around 1:30. Higher leverage can only be accessed by traders who have been categorized as professional traders.

Is Trade.com legit? A look into its Customer Support

Trade.com website is multilingual and is available in 12 languages. Customer support quality at Trade.com is great. It is possible to reach the agents 24/5 via telephone, email and live chat.

Deposits and Withdrawals

Trade.com offers various payment methods on its website. To fund the account, the client can use credit/debit cards, wire transfer and other remittance methods like Skrill, Safeguard and Neteller. Withdrawals are made quickly at Trade.com, provided that the client has submitted all the necessary KYC documentation beforehand.

Conclusion: Trade.com is legit

As can be seen from our honest Trade.com review, this broker certainly deserves your attention. If CySEC or FCA license is important for you – we advise you to sign up with this broker! It is also important to remember that no matter what kind of license a broker might have and how good the services they offer are, they are still not able to limit the risk that is associated with CFD trading.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.84% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Comments (0 comment(s))