Avoid Pitfalls Using Leverage in Forex Trading

The relatively recent rise of leveraged margin trading among retail forex traders using online forex brokers has put a spotlight on the magnified risks and pitfalls of trading currencies on margin.

What all reputable foreign exchange brokers should tell you when you open an online trading account, is that trading forex on margin — especially using the high maximum leverage ratios that such currency brokers often offer — can easily blow out all but the best funded accounts.

This sad fact often becomes a notable problem for currency traders who find themselves positioned on the wrong side of the market during one of the spectacular bouts of unexpected central bank intervention or a surprise monetary policy shift that can dramatically affect relative currency valuations.

During the resulting sharp valuation shifts that occur, little normal trading can take place, even in the highly liquid forex market. As a result, even stop loss orders prudently used for risk management purposes can be subject to significant slippage that can quickly deplete a poorly funded online trading account.

In addition to these occasional forex market events that can severely traumatize traders and their accounts, traders would be wise to avoid a number of other more common leverage related pitfalls dealing currencies via online forex brokers.

- Not Having a Sound Risk Management Strategy

As soon as you begin taking risk as a forex trader, you need to learn how to manage it. Letting your profits run and cutting your losses short can provide a time honored good start in this regard. Most successful forex traders will place take profit and stop loss orders at appropriate levels for their risk tolerance with their currency brokers. They typically do this in a very disciplined, objective and unemotional way as part of their risk management strategy to avoid a myriad of other trading problems.

- Failing to Enter Orders

Even the most disciplined trader can make a mistake, and failing to enter an order to manage the risk on a highly leveraged position can cost a trader their account. Minimize the risk of such errors by double checking your orders before the market moves significantly after initiating a leveraged position.

- Taking on Too Much Trading Risk

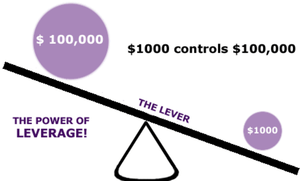

If you do not know how to assess risk properly, you are probably taking too much risk, especially if you are trading on margin. Using leverage can greatly increase the risk on a trading position, so make sure that your online trading account can afford to take any potential losses that might arise.

- Having Net Losing Positions Liquidated

Many online currency brokers will automatically liquidate a trader’s open positions in their online trading account if the amount of margin on deposit falls below a certain amount, even when the positions may ultimately have been profitable and were protected with stop losses. As a prudent trader, make sure you know exactly where this liquidation boundary is for your account and avoid this pitfall by reducing your margin usage or by adding to your account’s funding before liquidation occurs.

Basically, the ready availability of high leverage ratios offered by even the best forex broker means that forex traders who aspire to be successful need to closely manage how much of this sharp two edged sword they want to use.

Using too little leverage can result in a profitable trader only barely justifying their time spent trading, while employing too much leverage can rapidly deplete an online trading account. Accordingly, finding that optimum amount of leverage that is right for your situation and then avoiding the aforementioned pitfalls should give any forex trader a better chance of achieving sustained profitability over the long term.

For more exclusive content, follow us on Twitter or join us on Facebook.

Comments (0 comment(s))