Will there be a shift in the top forex brokers’ trading volume in 2018?

This year has seen major changes in the forex and binary options industries. However, most of the changes have still not been implemented – that happens next year, come 2018. Already, the forex brokers’ trading volume has shifted somewhat in light of the changes to come, a jostling for position so to speak. There is definitely going to be a shift in trading volumes in 2018 as the retail FX industry seems to be as unstable as never before, and here is how and why this is going to happen.

How do regulatory changes affect forex brokers’ trading volume?

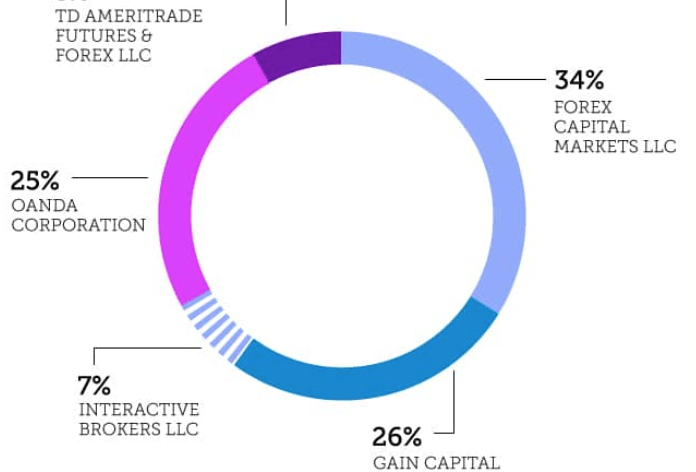

Here, you can see the list of top Forex brokers here sorted by volume transacted daily. Besides the volume, you can also see the change experienced within a year. The first thing you notice is how there has already been a shift in trading volume based on location.

Forex brokers’ trading volume rose significantly in Australia, moderately in the US but dropped in the UK. As this is where the changes in financial regulations are taking place, we can predict that there may be even further decreased in trading volume within this region. It is, therefore, possible that the share of forex brokers’ trading volume will shift away from the UK, although gradually at first.

Besides the shift in trading volume, a few new names have been included and others excluded. FXCM, which used to be among the top 3 is now absent, replaced by new brands. Come 2018, it is likely we shall see new names on that list as there continues to be a shift in forex brokers’ trading volume onwards.

How forex brokers shall cope with regulatory changes

Unfortunately, there isn’t a single solution to regulatory changes that shall work for everyone. However, we can look to the past at how the most successful forex brokers have been handling these changes for possible predictions on the shifts coming in 2018.

Seeking a different category of clients

Many of the changes in regulation seem to attack the largest client demographic – the amateur trader with little capital. These traders were initially attracted to the forex market by lucrative options such as high leverage and welcome bonuses. As these offers are eradicated under new regulations, this type of trader will be less inclined to trade. Since there is nothing the brokers can really do about that, they are shifting their ideal client target. Rather than the typical retail trader, forex brokers shall instead focus on high net-worth traders.

This strategy has already been seen to work based on IG Group shares early this year. Despite the new rules negatively affecting the majority of their clients, the company’s share price still rose. Apparently, about 80% of their non-US revenue comes from less than 10% of their client base. These are traders to whom the regulatory changes don’t apply, after all, they don’t even receive 500:1 leverage or welcome bonuses. Besides, they are responsible for the most forex brokers’ trading volume. Therefore, we may see a conscious drive by forex brokers in 2018 to try and attract the high net-worth client over the newbie.

Mergers and consolidation

With such stiff competition, it takes muscle to get noticed, and that means marketing and advertisement. For smaller brokers, the challenge can be enormous compared to their more established competition. Nevertheless, together they may actually benefit from one another. As the regulatory climate seeks to squeeze out the smaller brokerages, do not be surprised to see more mergers and acquisitions happen in 2018. Even with negligible forex brokers’ trading volume, together two or three startups can become just big enough to put up a fight.

Going beyond borders

According to the Bank for International Settlements (BIS), 5 regions in the world accounted for 77% of the total forex brokers’ trading volume. The UK is still the most active region, and so was the US, but their share was declining. In the UK, its share declined from 41% in 2013 to 37% in 2016; while there was no change in the US at 19% in 2013 and 2016. Meanwhile, the share of trading volume from Singapore, Hong Kong and Tokyo rose from 15% to 21%.

This would explain why forex brokers’ trading volume in the US and UK remained largely the same. In the US, Oanda did not experience any growth, and Gain Capital’s growth was only due to the acquisition of FXCM US clients. In the UK, Saxo Bank and IG Group also did not see any real growth in trading volumes. Whereas forex brokers’ trading volume for companies that ventured out rose. XM, Hot Forex, IC Markets all showed tremendous growth in trading volume from their exploits in Asia and Africa. For brokers trying to stay in the game longer, they are going to have to look beyond the established forex market hotspots.

Comments (0 comment(s))