Traders claim eToro forced stop loss against their consent

On eToro, it is mandatory for every position to use Stop Loss, the only exceptions are the non-leveraged buy positions. As traders on Reddit are claiming, the brokerage has forced a stop loss on their trades, which were non-leveraged buy positions. Traders on Reddit are specifically saying that they did not want to use stop loss, and as the brokerage forced it on them, they can’t reverse it.

“This is my money to lose… If I lose my positions, I will take legal actions,” wrote one of the users on Reddit.

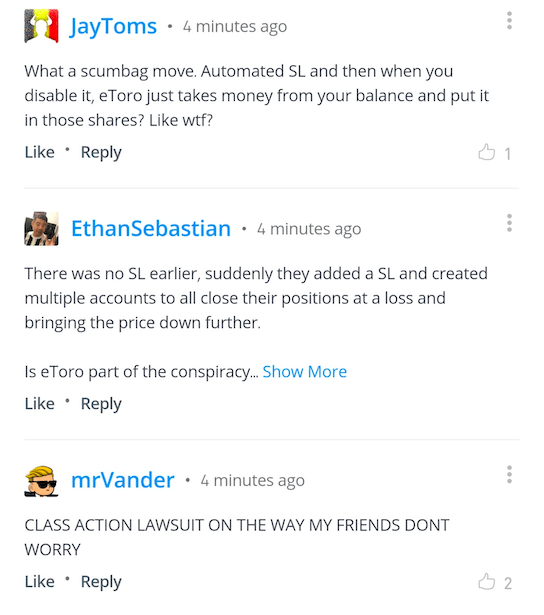

Another client of eToro claimed that when you disable the SL, eToro just takes money from the trader’s balance and puts it in the shares. This happened for GameStop traders, which is a company that has been under a great focus from trades globally.

As traders are saying, there was no Stop Loss earlier. As the brokerage added it on multiple accounts, it has forced the traders to close the positions at a loss, bringing down the price of the stock.

The traders are saying that the most unacceptable thing about this is that the brokerage did not even issue a warning. “My position was also forcefully closed on me! This is my money and a non-leveraged trade. This is 100% no fair and should be taken to justice,” wrote another user of eToro.

What is a stop-loss?

Stop-loss orders are placed by traders who want to limit their risks. In most cases, it is offered as an option through a trading platform when a trade is placed. It can also be changed at any time. Once the price threshold is reached, the stop loss activates market order.

Stop-loss orders are placed by traders who want to limit their risks. In most cases, it is offered as an option through a trading platform when a trade is placed. It can also be changed at any time. Once the price threshold is reached, the stop loss activates market order.

Every broker has different types of requirements and laws regarding stop-loss. Mostly it is something that the trader has control over. Stop-loss was created to limit the losses of traders, and by forcefully adopting them, Forex broker is creating a lot of problems for traders.

Although it is designed to safeguard traders from higher risks, using it forcefully can be riskier for traders. According to the official information from eToro’s website, a Stop Loss is mandatory in every position. However, there is an exception. For non-leveraged buy positions, stop-loss is not mandatory.

The positions that eToro forced SL onto were non-leveraged buy positions. This goes against the official statements of the broker. What’s worse is that the broker did not make any warning or previous statement regarding the step that it was planning to make.

A huge majority of eToro users are claiming that they were unable to reverse the SL. Some even said that they have ended up losing a certain amount of money because of the forceful SL. One of the users noted that they lost $30. The broker has inserted a -20% Stop Loss on non-leveraged positions.

As one of the clients of eToro wrote, he bought the shares of GameStop at $298. EToro sold it without any previous warning at $232, after which, the trader bought it back at $243. “They created the low of the morning by selling their customers shares without warning in massive volume,” writes one of the clients.

The step comes after the developments in the stock trading market. Redditor traders have previously decided to buy the shares of underperforming companies, that were largely shorted. As a result, the prices of such companies, one of which was GameStop, have skyrocketed.

After such events, leading brokerages online have decided to impose special limitations on trading several companies’ shares. This was followed by a massive backlash online, some traders even filed legal lawsuits. As some of the brokers are trying to limit access to the shares of companies with huge demand, traders of Reddit are saying that they are nowhere close to stopping.

Comments (0 comment(s))